Changes in the tax-deductible expenses limitations on cars, brought by the Recovery Tax Package, also impact the Value Added Tax (VAT) law.

In this part of our series on the Recovery Tax Package, we will focus specifically on VAT deductions.

Limitations on VAT Deductions

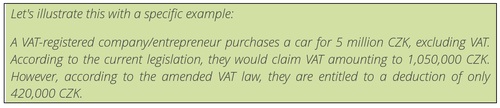

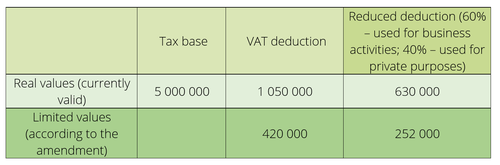

As mentioned in our previous articles, both tax-deductible expenses for the purchase of a vehicle and VAT deductions are limited. The maximum deductible tax expense is 2 million CZK, which also corresponds to the tax base for deductible VAT. Therefore, VAT registered companies will now be able to claim the maximum deduction from newly acquired cars of 420,000 CZK.

In cases where a company or entrepreneur purchases a car for the purpose of further sale (i.e., it is not a long-lived asset but goods), the deduction can be claimed in full, without limitation, in accordance with the law.

However, if there is a change and the car purchased for sale is later classified as a long-term asset, the VAT registered company/entrepreneur is obliged to reduce the claimed deduction so that it amounts to a maximum of 420,000 CZK. The reduced deduction should be stated in the company’s/entrepreneur’s tax return for the tax period in which the car was classified as a long-lived asset.

Selling Cars With Limited VAT Deduction

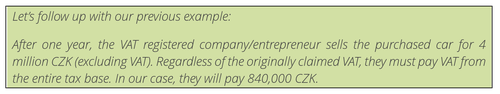

When selling a car, the limitation on the possibility to claim on-input tax deduction is not considered.

In practice, this can lead to a significant discrepancy between the claimed deduction and the VAT payment.

Reduced VAT Deduction

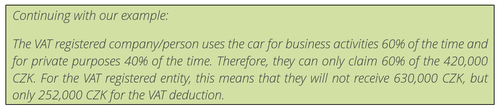

A common occurrence for VAT registered companies and especially for natural persons is the use of a company car also for private purposes. This affects the deduction they can claim.

Although electromobility has been a major favored topic in recent years, there are no exemptions for low-emission or zero-emission vehicles from the rules mentioned above. Thus, limited VAT deductions apply regardless of the type of propulsion of the purchased vehicle.

Download PDF: VAT-DEDUCTION LIMITATIONS ON CARS