New meal allowance rates and the average price of petrol on business trips.

The Ministry of Labour and Social Affairs responded to the general increase of prices and recently adjusted the rates of meal allowances for employee business trips and set the average price for 98 octane petrol. It is already the fourth amendment to the Regulation this year. In this Article, we provide you with a useful overview.

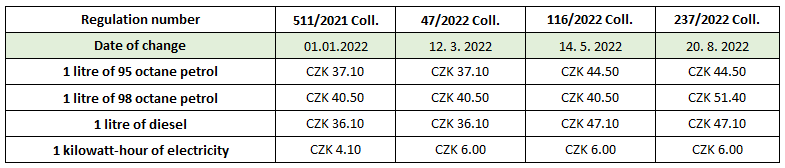

- Average prices of fuel

In the chart below, average prices with effective dates of individual regulations are shown. Please note that an employee proves the price of fuel with a purchase receipt. Where no receipt can be submitted, employers may use the average price determined by the Regulation. At times of great price fluctuations, as we are experiencing right now, officially determined prices are often very different from the real prices. Employers should therefore consider placing a greater emphasis on proving the price actually paid at a filling station.

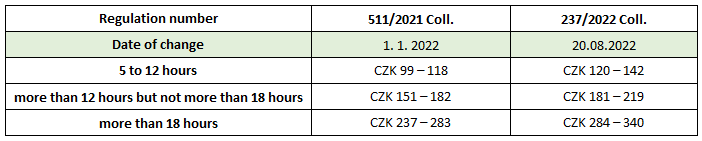

- Increased meal allowance for local business trips

Meal allowance rates for local business trips have been significantly increased.

In the governmental administration sphere, meal allowances must always fall within the relevant determined ranges. In the business sphere, employers must always observe the minimum rate provided by the Regulation, but they are allowed to pay a rate above the determined range. Meal allowances above the maximum rates provided in the Regulation in the governmental sphere will not be a tax-deductible expense for the employer.

- Subsistence allowance may be increased as well

The maximum rate of subsistence allowance is linked to the rate of meal allowance for business trips. A financial allowance per one shift is exempt from income tax on the employee’s side (thus exempt also from contributions) up to 70% of the upper limit of meal allowance for a business trip taking 5 to 12 hours. So far, in tax terms, it was most advantageous for employers to make contributions at the rate of CZK 82.60 but as of 20 August, the contribution can be increased to CZK 99.40 (70% of CZK 142.00).

The growing prices are obviously frustrating both for employers and employees, and it is just as well that the Ministry responds to them. The question is whether the way they chose to do so is the best one possible, since it might result in excessive paperwork.