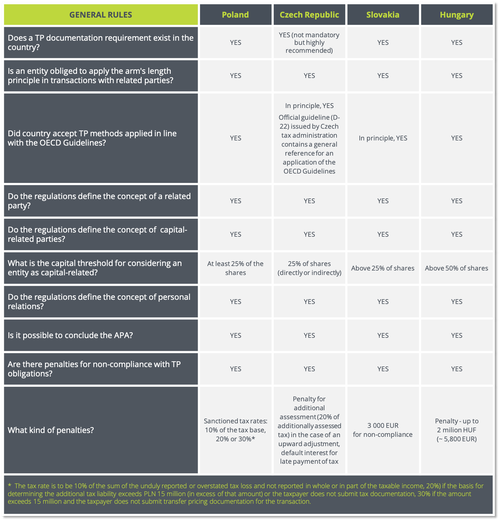

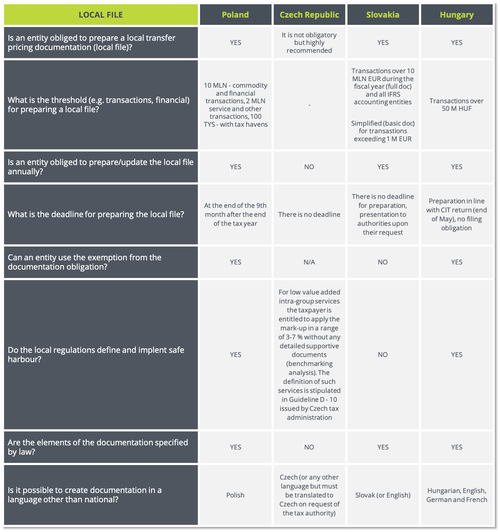

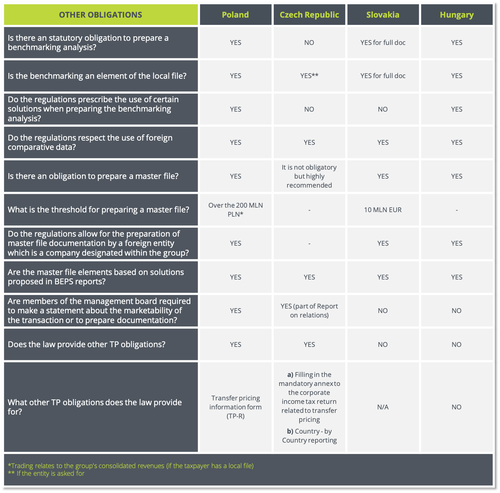

Transfer pricing regulations around the world grow at a fast pace as a result of the implementation of the Action Plan on Base Erosion and Profit Shifting (BEPS) developed by OECD in national tax environment recommendations. Local regulations introduce specific transfer obligations that are relevant exclusively for local entities, such as Transfer Pricing rules applicable for Polish CIT and PIT taxpayers. For example in Poland under the Anti-Crisis Shield 4.0. Act transfer pricing deadline for preparation of Local File documentation, submission of TPR-C form, and TP statement for FY 2019 was prolonged until 31 December 2020. The deadline for possessing Master File for FY 2019 was prolonged until 31 March 2021.

What is important, a company should carry out its business activities in accordance with transfer pricing rules and anti-base erosion and profit shifting provisions.

Our tax specialists follow current CEE countries’ tax laws, rulings, and jurisprudence in this matter.

Content presenting transfer pricing obligations of CEE’s countries was updated as of May 2020 and should not be regarded as legal nor tax advice. Should you wish to obtain more detailed information, please contact our tax advisors.

Piotr Szeliga

Tax Manager - Tax Adviser

E: pszeliga@asbgroup.eu