From 2024, it will now be possible to exclude unrealised exchange rate differences from the tax base.

According to the upcoming amendment to the Income Tax Act, which is part of a consolidation package, it will be newly possible from 2024 to exclude unrealized foreign exchange differences from the tax base. Consequently, only realized foreign exchange differences will be included in the tax base.

Foreign exchange differences generally arise due to the fact that the Accounting Act requires accounting entities to keep their accounts in Czech currency (note: from 2024 it will be possible to switch to a functional currency other than Czech koruna). When an accounting entity accounts for a receivable or liability with a foreign business partner, these are recorded at the valid exchange rate at the time of the accounting transaction. A foreign exchange difference occurs at the moment the receivable or liability is settled and the payment is recorded at the exchange rate of the day the payment was made. In this case, we speak of realized foreign exchange differences.

Unrealized foreign exchange differences are those that arise from the valuation of selected accounting items at the exchange rate on the balance sheet date. If an accounting entity records receivables or liabilities in foreign currency at the end of the period that have not been settled, these items must be recalculated at the exchange rate on the balance sheet date. The resulting difference from the original valuation is recorded with an impact on the financial result.

At present, i.e., still for the tax return for the year 2023, any foreign exchange differences are included in the tax base. If the taxpayer wishes to proceed according to the amendment, it will be possible from the tax period starting no earlier than January 1, 2024. Entry into this regime is entirely voluntary.

The conditions for entering the regime of excluding foreign exchange differences are as follows:

- The taxpayer maintains double-entry accounting.

- No insolvency proceedings have been initiated against the taxpayer.

- The taxpayer is not in liquidation.

- The taxpayer must submit a notification of entry into the régime.

Notification to the tax administrator of entry into the regime for excluding foreign exchange differences must be submitted within 3 months from the first day of the relevant tax period, i.e., in the case of a tax period equal to the calendar year, by March 31. The notification can be changed or withdrawn until the deadline for its submission. After the deadline, the notification cannot be withdrawn.

The regime of excluding foreign exchange differences can be terminated voluntarily or mandatorily based on the facts stated in the law. In the case of voluntary termination of the regime, the taxpayer can exit the regime after the second tax period following the period in which the intention to leave the regime was announced. The notification of withdrawal from the regime for excluding foreign exchange differences cannot be taken back. Let's illustrate this with an example:

The taxpayer entered the regime for excluding foreign exchange differences for the tax period of 2024 and subsequently found that it was not beneficial. In 2025, they decide to exit and notify the tax administrator of this fact. However, they must remain in the regime for excluding unrealized foreign exchange differences for the next two tax periods, i.e., 2026 and 2027. The regime ends on December 31, 2027, and from January 1, 2028, unrealized foreign exchange differences are taxed as usual.

Exiting the regime also brings the obligation to pay additional tax on all unrealized foreign exchange differences that have been excluded so far.

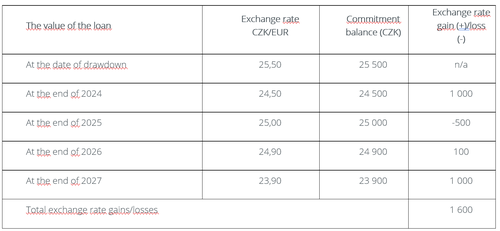

Let's demonstrate the additional payment of unrealized foreign exchange differences with a simple example of a foreign currency loan (liability) valued at 1,000 EUR, which is not being repaid incrementally. Assume a EUR loan with a zero-interest rate taken out in 2024. The loan must be revalued each year at the exchange rate as of December 31. Over the years, as the koruna fluctuates against the EUR, exchange gains or losses from the recalculated balance of the debt are accounted for. In the normal regime, these costs or revenues enter into the tax base.

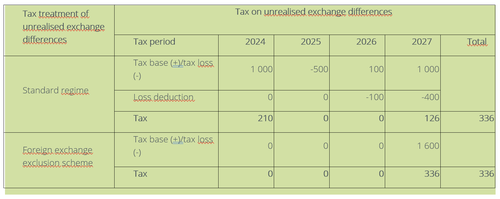

The following table illustrates a comparison of a taxpayer in the normal regime and in the regime of excluding unrealized foreign exchange differences. In the normal regime, the taxpayer realizes taxable gains or losses over the years from the revaluation of the liability at the exchange rate, which are subject to taxation, while for the second taxpayer, the revaluation has no impact on their tax obligations. However, if they decide to exit the regime, in our case, they will have to pay additional tax on all exchange gains or losses in the last year of staying in the regime, i.e., in 2027.

From the model example, it is apparent that in the first case, the tax obligation is spread over individual years, while for the taxpayer in the regime of excluding unrealized foreign exchange differences, taxation occurs in one lump sum upon exiting the regime. However, the total tax burden is the same for both taxpayers.

In the case where the taxpayer does not exit the regime of excluding foreign exchange differences but persists until the debt is realized, i.e., the loan is repaid, only the exchange difference at the realization will be taxable.

It is certainly wise to consider whether the regime of excluding unrealized foreign exchange differences makes sense for you. If you are interested in this change and would like to take advantage of the regime of excluding unrealized foreign exchange differences, do not hesitate to contact us. We are happy to help you with everything and explain it .

Download PDF: Exchange rate differences exclusion scheme - Income Tax