We informed you about planned changes in the field of tax-deductible expenses for cars. We are now going to focus on what these changes will mean in practice.

Many of us surely remember the expenses limitations for cars, which used to be included in the legislation. Back then, the law regulated the entry price of the assets, whereas now, tax-deductible expenses in the form of depreciation or residual cost will be limited.

For future car owners, it may be good news that they will still be able to choose between straight-line, accelerated, or special depreciation.

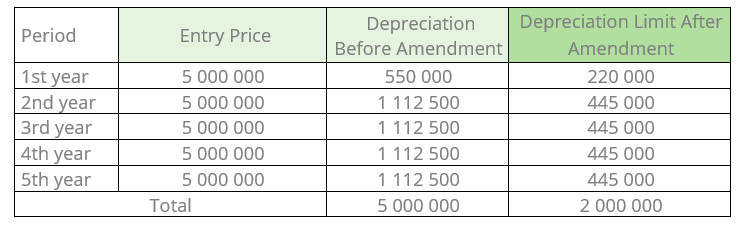

Let's illustrate the difference in expenses deduction with a specific example.

Example

The entry price of a passenger car is 5 million CZK. Currently, it is possible to deduct the entire entry price from the tax base as tax depreciation, whereas in the future, only 2 million CZK will be deductible. In the aforementioned case, the tax-deductible expense will decrease by more than 50% per year.

Sale of Vehicles With Limited Depreciation

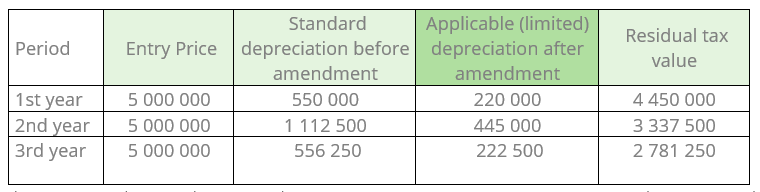

The draft bill also considers adjusting the residual cost of cars whose depreciation will be limited by it. The residual cost can be deducted e.g. when selling a car or disposing thereof. When determining tax depreciation, the law specifies only the minimum depreciation period, and it is possible to interrupt depreciation at any time. Therefore, the bill proposes that the tax residual cost be newly based on the minimum depreciation period, regardless of its suspensions. The tax residual cost will then be determined as the difference between the entry price and the total amount of (unlimited) depreciation, even if only limited depreciation was included in the expenses.

Example Continues: Selling or Disposing of Cars in 3rd Year of Depreciation

Three years after purchasing the car, it is sold. It will be possible to deduct the residual cost of the property, which, when using straight-line depreciation, amounts to 2,781,000 CZK, even though tax expenses only accounted for depreciations of 887,500 CZK.

The proposed amendment to the Income Tax Law is quite extensive in this area and includes several comprehensive new provisions. Among other things, they regulate the procedure of depreciation deducting after a technical evaluation, deducting expenses on a finance lease, and the method for calculating tax-deductible expenses on co-owned cars.

Practice will certainly bring a variety of combinations of these situations. Therefore, calculating tax-deductible expenses may, in the future, represent an interesting mathematical challenge.

Download PDF: Depreciation limit for cars - Part 2