We prepared a summary of the system of social policy of the Czech Republic and the Ministry of Labor and Social Affairs.

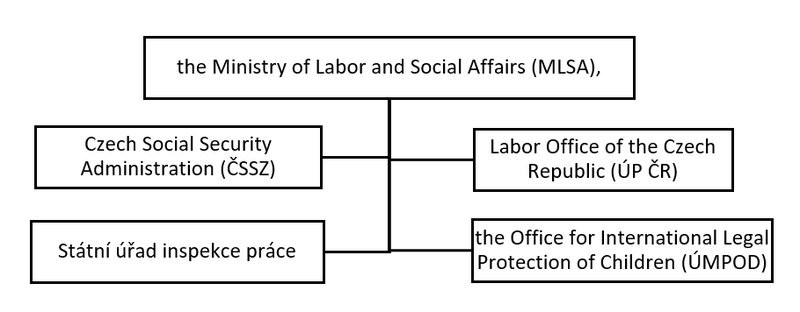

The Ministry's competence includes primarily the social policy of the state (issues of the people with some form of disability, social services, social benefits, family policy), social insurance (pensions, sickness), employment (labor market, employment support, foreign employment), labor legislation, security and health protection at work, equal opportunities for women and men (gender issues) or European integration and the area of drawing financial assistance from European Union funds. Amongst the subordinated institutions a total of four key institutions are subordinate to the Ministry of Labor and Social Affairs (MLSA), which are mainly the Labor Office of the Czech Republic (ÚP ČR) and the Czech Social Security Administration (ČSSZ), supplemented by the State Labor Inspection Authority (SÚIP) and the Office for International Legal Protection of Children (ÚMPOD).

Due to the wide field of activity and the several different organizations listed above, citizens, whether employers or employees, may be confused as to where to turn with a particular problem. And precisely because of this, we bring a brief summary of what the individual areas of operation mean and which of the mentioned state administration bodies is responsible for specific social events and the payment of the relevant benefits. The Ministry of Labor and Social Affairs divides its competence into 15 areas, such as pension insurance, health insurance, state social support, substitute alimony, and others. If we first focus only on the sphere of social security in the narrower sense, we will find that it is based on two basic pillars - pension and health insurance.

The following types of benefits are provided from the basic pension insurance - old-age (including so-called early old-age pensions), invalidity, widow's, widower's, and orphan's pensions. The Czech Social Security Administration decides on the entitlement to a pension, its amount, and payment, except in cases where the social security bodies of the Ministries of Defense, Interior, and Justice are competent to make decisions. The district social security administration (OSSZ), in Prague the Prague Social Security Administration (PSSZ) and its territorial offices, and in Brno, the Municipal Social Security Administration (MSSZ) are obliged to provide citizens and organizations professional assistance in matters of pension insurance.

Sickness insurance is primarily used for employed persons who have experienced a loss of their income due to a social event. According to Act No. 187/2006 Coll., On Sickness Insurance, a social event is defined as an event with which the Act on Sickness Insurance combines the origin of entitlement to benefits, the occurrence of temporary incapacity for work, quarantine order, the need for nursing allowance or care for a household member, for maternity allowance and the transfer of a female employee to another job, a civil servant to another official post or the appointment of a member of staff to another official post. It is apparent that the sickness insurance pays 6 cash benefits, namely sickness benefit, maternity allowance, nursing allowance, pregnancy and maternity allowance, paternity post-natal care benefit (so-called paternity), and long-term nursing allowance. All sickness insurance benefits are paid by the district social security administration, which has a payment period of one month following the day on which the application for the OSSZ benefit (or PSSZ, MSSZ) was delivered. To pay sickness insurance benefits it is necessary to mention that all calendar days are always paid for. In the event of a concurrence of entitlements to the same benefit from several occupations establishing participation in sickness insurance, only one benefit will be provided from all occupations, which will be calculated from the income earned in all these occupations.

Other areas under the management of the Ministry of Labor and Social Affairs include, for example, alternative alimony, assistance in material need, or state social support. The first of these is a novelty that has been introduced on July 1, 2021, and is a support to help single parents (their children) in a situation where one of the parents does not pay court-ordered maintenance. This benefit is paid through the contact workplace of the Labor Office of the Czech Republic according to the place of permanent residence of the entitled person, ie the child. On the contrary, assistance in material need means the whole system, which aims to combat social exclusion and help people with insufficient income. The benefits that address assistance in material need are subsistence allowance, housing supplement, and emergency immediate assistance (also emergency immediate assistance associated with covid-19), and their payer is the Labor Office of the Czech Republic.

The concept of state social support refers to benefits provided to persons (family members) in socially recognized social situations, where the state, through their payment, partially assumes responsibility for the social situation. Within the system of state social support, the following types of benefits are provided: child allowance, housing allowance, parental allowance, maternity, and funeral allowances. These so-called non-insurance benefits are also paid by the Labor Office of the Czech Republic and it should be mentioned that housing, child, and maternity allowance is affected by income and the other two are not (funeral and parental allowances have a fixed maximum amount paid, however, for the latter, it depends on the distribution of the length of parental leave by the applicant)