The amendment to the Accounting Act dated 1 January 2021 brought about, inter alia, a change in the procedure for publishing the financial statements of business corporations in the Collection of Documents.

To date it was possible to publish financial statements in the following ways:

- via data box,

- via the justice.cz online portal,

- or by sending an e-mail to the mailbox of the Commercial Register.

The simplest of the foregoing variants is submission in pdf format via the data box of the tax entity in question. In the case of online submission via the justice.cz portal or by e-mail to the mailbox of the Commercial Register, one must have a qualified electronic signature or a physical signature on the scanned document.

A new option is the possibility of submissions through the relevant tax administrator, i.e. the competent tax office. The earliest it will be possible to submit financial statements in this way will be for the 2021 tax period, i.e. in the financial statements to be submitted in 2022. The entity will then include the financial statements as an annex to the tax return. It is necessary to state the scope of publication of the financial statements by the tax administrator. The tax administrator is then obliged to enter the financial statements in the Commercial Register. Further details have not yet been provided by the tax administrator.

For confirmation, in the following text, we present a summary of the conditions for the preparation of financial statements and their publication.

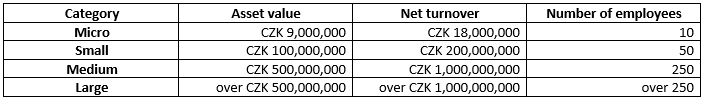

The amendment to the Accounting Act of 2016 introduced the so-called categorization of accounting units. The individual categories give rise to obligations regarding the scope of bookkeeping, the obligation to prepare financial statements within the accounts closing, the obligation to have the financial statements verified by an auditor, and the obligation to have financial statements and other documents published in the Collection of Documents.

When a new accounting entity begins operations, the entity is required to determine its category based on its own qualified estimate. In the case of existing entities, this must be done at the end of each testing period. If for two consecutive balance sheet days, an entity exceeds or ceases to exceed at least 2 of the thresholds for that category, it shall change the entity's category from the beginning of the next period and comply with the obligations arising therefrom.

For the asset value, it is necessary to take the net value for the current period stated in the balance sheet. The annual total net turnover can be found in the profit and loss statement. However, it is necessary to divide this value by the number of months completed or begun, and then to multiply this by 12 in order to be able to correctly assess the turnover for the whole period even in the case of a shortened period. The number of employees is determined on the basis of the average recalculated a registered number of employees according to the methodology of the Czech Statistical Office.

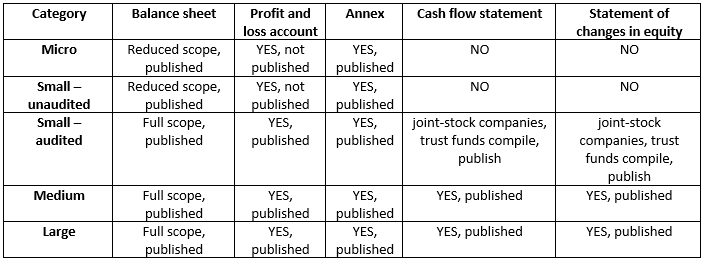

Micro and small accounting entities, the financial statements of which do not need to be audited, need only prepare a summary of the balance sheet and are required to publish only the balance sheet and the notes to the financial statements. They do not, therefore, need to publish a profit and loss account. The statement of cash flows and the statement of changes in equity need not be prepared.

Small accounting units subject to statutory audit must draw up a full balance sheet. In addition to the balance sheet and the notes, they must also publish a profit and loss account. In the case of joint-stock companies and trust funds, small accounting entities must also prepare and publish the statement of cash flows and the statement of changes in equity.

The requirement for an audit of an accounting entity arises when the following criteria are exceeded: assets of more than CZK 40,000,000, net annual turnover of CZK 80,000,000, more than 50 employees. In the case of joint-stock companies or trust funds, at least one criterion must be exceeded; in the case of other types of companies, two criteria must be met. Unlike the assessment of an entity's category, the assessment of the audit requirement is based on the values at the balance sheet date of the accounting period for which the financial statements are being audited and the accounting period immediately preceding.

Medium and Large units have the obligation to prepare financial statements in full (including an Annual report) and to publish all documents so prepared.

Under the Accounting Act, an entity is required to publish financial statements within 12 months of the balance sheet date of the financial statements being published. If an entity is required to have its financial statements verified by an auditor but the financial statements have not been approved by that date, the entity shall still publish the financial statements and provide the information that the financial statements have yet to be approved.

Do not forget also to publish the Related Parties Relations Report. This should be prepared within 3 months of the end of the accounting period and should be published by the deadline for publishing the financial statements.

Penalties for non-compliance with the publication deadline

Failure to comply with this requirement is considered a breach of the duty of care of a manager acting with due diligence and according to the Accounting Act, the tax office may impose a fine of up to 3% of the value of the assets stated in the financial statements. According to the Registers Act, a disciplinary fine of up to CZK 100,000 may be imposed by the Registry Court. If this requirement is violated repeatedly, the court may in certain cases initiate proceedings to have the registered entity dissolved by liquidation.