In 2026, new obligations related to public Country-by-Country reporting (Public CbC-R) will take effect, changing the existing rules for preparing and disclosing tax information by the largest corporate groups. For globally operating companies, this is not only a reporting requirement but also an important element of transparency and reputation-building vis-à-vis investors, customers, and the market.

Public CbC R was introduced by Directive (EU) 2021/2101 of the European Parliament and of the Council of 24 November 2021. The objective of this regulation is to enhance the tax transparency of multinational enterprises and enable broader public scrutiny of tax-related information disclosed by large groups.

In Poland, the Directive has been implemented through an amendment to the Accounting Act (UoR), which introduced Chapter 6b, “Report on income tax”, governing the principles for the preparation, publication, and disclosure of Public CbC R.

What is Public CbC-R and what makes it different?

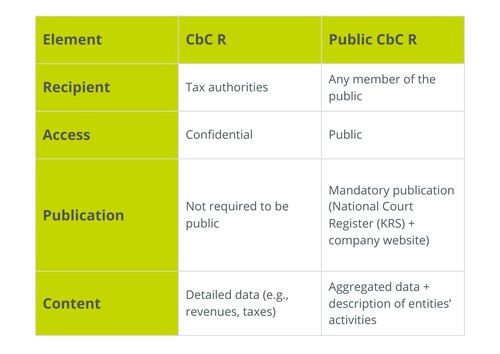

Country-by-Country Reporting (CbC-R) is the reporting of financial and tax data by jurisdiction, previously prepared exclusively for tax authorities. Its purpose is to assess transfer pricing risks within an international group and to support tax compliance.

Public CbC R is a separate report from the traditional CbC R. Under Directive (EU) 2021/2101, it must be publicly accessible, widely published, retained for a specified period, and it discloses information on business activity and taxes paid by group entities across different countries.

Key differences between CbC R and Public CbC R

Who is required to prepare Public CbC-R?

The obligation applies to:

- Ultimate parent entities (top-tier parent entities) or standalone entities whose consolidated or individual revenues exceeded PLN 3,500,000,000 in each of the last two financial years.

- For groups whose ultimate parent entity is established outside the EEA and whose revenues exceed EUR 750,000,000, the obligation applies to subsidiaries or branches that meet the specific conditions set out in the Accounting Act (UoR).

Exemptions

The provisions do not apply to groups whose all subsidiaries and branches operate exclusively in Poland and have no activity abroad. This means that the Public CbC R obligation is intended to cover genuinely international operations.

What should the public CbC report contain?

Public CbC R should include data that was previously prepared for tax authorities; however, in line with the EU Directive, it must also include additional elements, such as:

- The names of the ultimate parent entity and subsidiaries, together with a brief description of their activities.

- Country-by-country information on operations, including, among others:

- the number of full-time equivalent employees,

- consolidated revenues,

- profit (or loss) before income tax,

- income tax accrued and income tax paid.

These data must be prepared electronically, in the official language of the reporting entity, in the group’s reporting currency, and must be accompanied by an appropriate electronic signature compliant with the Accounting Act (UoR).

Where and when should the report be published?

Public CbC R must be:

- prepared within 12 months of the balance sheet date,

- filed with the National Court Register (KRS),

- made available on the reporting entity’s website, and

- kept publicly accessible for at least 5 years from the date of publication.

For entities whose financial year aligns with the calendar year, the first public report will cover 2025 and must be published by 31 December 2026.

What changes compared to the existing CbC R?

New Public CbC R obligations include:

- A separate report in addition to the existing CbC R—meaning companies may prepare two distinct reports: one for tax authorities (CbC R) and one for the public (Public CbC R).

- The scope and format of data are adapted for public disclosure.

- Public availability entails additional reputational risks and requires careful consideration of how information is presented.

Frequently Asked Questions

- Does Public CbC R replace the traditional CbC R?

No. Public CbC R is a separate report with a different purpose and is published publicly, while the standard CbC R remains a document filed with tax authorities. - Does every large taxpayer have to publish Public CbC R?

No. The obligation applies only to groups whose consolidated revenues exceed specified thresholds and which have foreign subsidiaries or branches. - How long must the report be retained?

The public report must remain publicly accessible for at least 5 years from publication. - Must the data be electronically signed?

Yes. The electronically prepared report must include an appropriate electronic signature in accordance with the Accounting Act (UoR).

How ASB Group can we support your company?

Implementing Public CbC R is a comprehensive process that includes financial data analysis, review of accounting systems, preparation of the report, and its publication in the appropriate register and on the company website.

The ASB team can support your company in:

- assessing reporting obligations – verifying whether the group meets the criteria for Public CbC R,

- preparing and consolidating data – assisting with collecting information from subsidiaries,

- process optimisation – advising on how to efficiently implement reporting procedures compliant with the Accounting Act (UoR) and the EU Directive.

Contact our expert for further assistance: