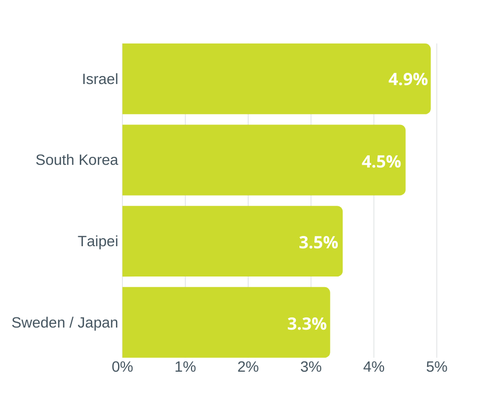

For a few latest years, many developed and developing countries have been promoting R&D activities. The surge in R&D expenses is however not unexpected – most economists agree that this is the only way to avoid the middle-income trap. Leaders in this field in 2018 were: Israel, South Korea, Taipei, Sweden, and Japan:

R&D in GDP – worldwide leaders / 2018

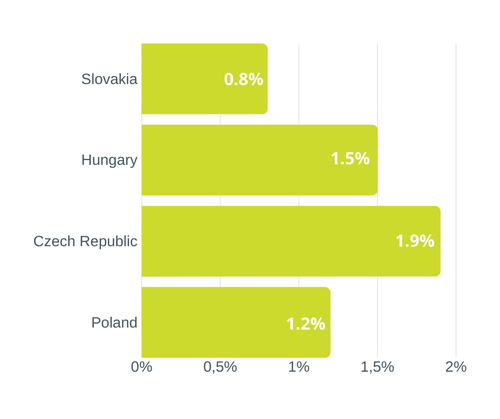

Level of R&D expenses in GDP is significantly lower in CEE countries when compared to worldwide leaders in this field:

R&D in GDP – CEE / 2018

Is this a pure coincidence that the R&D level is higher in Hungary and the Czech Republic, in comparison to Poland and Slovakia? Not really.

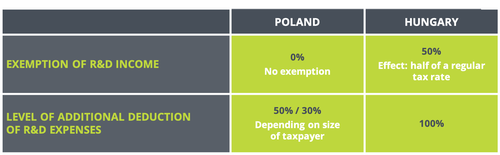

Most importantly, Hungary introduced the first benefits for IP related activities already in 2003. It included in particular 50% exemption of R&D income and double deduction of R&D costs. Please note that it was seventeen years ago – at the time when there were absolutely none R&D incentives in the Polish tax system. First R&D incentives were introduced in Poland in 2006 and were noticeably less preferential than the Hungarian ones, please see the comparison:

Old R&D regime

In fact, most Polish entrepreneurs started to apply for tax R&D incentives only when a brand new instrument was introduced in 2016: R&D tax relief which replaced the old R&D incentive for new technologies. The level of additional deduction of R&D expenses gradually increased within the new instrument to ultimately reach 100% for regular entities and 150% for entities having the status of R&D center.

Additionally, as of 2019 new IP BOX regime was introduced in Poland which basically allows applying preferential 5% CIT or PIT rate - whereby the regular one in Poland for business income is generally 19% - towards income from commercialization of R&D.

Combine it with a possibility to introduce lump sum costs (amounting to 50% of revenues) of R&D employees and you may achieve quite a synergy in terms of R&D incentives in Poland.

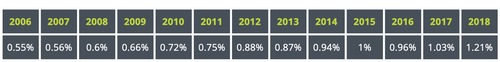

Introduction of these new instruments, as well as tax-free areas and EU grants, increased R&D / GDP ratio in Poland in the latest years as follows:

R&D in GDP / Poland

Of course, our neighbors also introduced or increased the level of existing R&D tax incentives. For example, as of 2015, Slovakia introduced an additional 125% - 150% deduction of R&D expenses. Additionally, in 2018 the Patent Box regime was introduced allowing for exemption of 50% of R&D income and resulting in an effective tax rate of 10.5%.

Czech Republic did not introduce the IP Box regime yet, but in 2014 the level of additionally deductible R&D costs was increased from 100% to 110%. Another amendment of 2016 introduced the possibility to recognize as qualified cost expenses incurred on R&D product certification.

We believe that taxpayers of CEE countries may expect another R&D tax incentives in the upcoming competitive years.

Łukasz Bączyk

Head of Tax

E: lbaczyk@asbgroup.eu

Jarosław Szajkowski

Tax Manager - Tax Adviser

E: jszajkowski@asbgroup.eu

Marta Skrodzka

Tax Manager - Tax Adviser

E: mskrodzka@asbgroup.eu

Piotr Szeliga

Tax Manager - Tax Adviser

E: pszeliga@asbgroup.eu

Paweł Jóźwik

Tax Manager - Attorney-at-law

E: pjozwik@asbgroup.eu