There have been many changes in the taxation package which has been in force since 1 January 2021, of which the abolition of the super-gross wage has probably had the greatest publicity.

However, among these changes also included the introduction of a progressive personal income tax rate, which may also have an impact on you.

Progressive tax rate

First, let us explain what a progressive tax rate means. Until 2020, the linear tax rate in the Czech Republic was 15%, i.e. the income of all individuals was taxed at the same rate. There was also a solidarity tax increase of 7%, which applied only to income from employment and business. These rates have been abolished from 2021 and replaced by a progressive tax rate with 15% and 23% bands. What does this mean? If you have an annual income of up to 48-times the average wage (CZK 1,701,168 for 2021), then you can rest easy, your income will be taxed at only 15%. But once your total income exceeds this limit, then everything above the limit must be taxed at 23%.

The biggest difficulty with this new progressive taxation is that, unlike the solidarity-based tax increase, the progressive tax rate applies to the entire tax base, including, for example, income from rentals or from capital assets. Let us give an example.

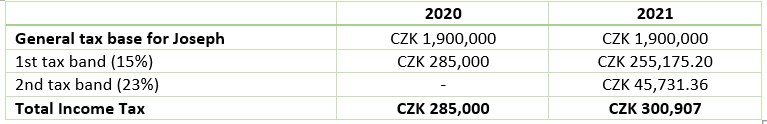

Example: Joseph has several types of income: his business income after deducting expenses is CZK 1,300,000; his income from a profit share paid out of Germany to the value of CZK 100,000; and income from long-term rental of his apartment to the value of CZK 500,000 after deducting expenses. What will be Joseph’s total income tax for 2021? We do not consider allowances or deductions in these examples.

So in our example, Joseph will pay CZK 300,907 in tax, CZK 15,907 more than he would have paid in 2020 on the same income.

Progressive taxation will increase the final tax in the case of incomes above 48 times the average wage; however, at the same time as the introduction of this progressive taxation, the so-called super-gross wage was abolished. Much has already been written on this topic, so just to recapitulate, the abolition of the super-gross wage leads to taxation from a lower tax base. Previously, income tax was calculated from the tax base at the level of super-gross wages, which was the gross wage plus compulsory social and health insurance contributions paid by the employer to the value of 33.8%. From 2021, tax is calculated only on the gross wage, which overall means lower tax on income from employment. For most employees, therefore, the introduction of the taxation package means a reduction in the tax liability even if the limit is exceeded and their income is partially taxed at the higher tax rate.

Separate tax base - a new option for income from foreign capital

Income from profit sharing or interest income paid from abroad is taxed as capital income in the general tax base. Therefore, if the total income limit were exceeded, this income would also be subject to higher taxation at 23%. An amendment to the Act now makes it possible to include these incomes in the so-called separate tax base with a tax rate of 15% and thus avoid progressive taxation. Please note that in some situations it may be better to include income from abroad in the general tax base - this is mainly due to various allowances and deductions that cannot be applied to a separate tax base.

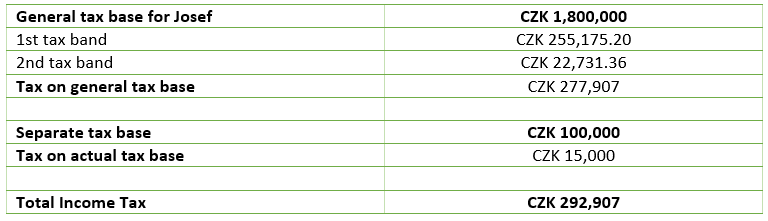

Example: still working with Joseph's income from the previous example... In this case, Joseph will include the income from the profit share paid from Germany in a separate tax base. What will be Joseph’s total income for 2021? In the example, we do not take into consideration any tax paid abroad.

If Joseph includes income from a profit share of CZK 100,000 in a separate tax base, then his tax liability will be reduced by CZK 8,000. If the profit share were taxed in Germany, then it is possible to offset the tax under the international agreement on the avoidance of double taxation and thus reduce the tax paid in the Czech Republic.

Another way to at least partially reduce the tax base for progressive taxation is through the system of cooperating persons. However, the system only works for business income, by transferring part of the income to a so-called cooperating person, such as one’s wife. This transfer of part of the income will reduce your tax base and you can thereby avoid the higher tax band.

Beware of other non-exempt income!

Are you selling a cottage or an apartment that you have been renting? Then be careful, since progressive taxation also has an impact on these one-off cases. When selling real estate, a time test must be applied in order for income to be exempt from tax. For a property at which you have not been resident, and which you acquired before 2021, a time test of 5 years is applied, for real estate acquired from 2021 onwards, the test interval is 10 years. If you pass the time test, that is, you have been the owner of the property for more than 5 or 10 years respectively, then the sale is exempt income. However, if you do not pass the test, the profit from the sale must be taxed and it can easily happen that you will have to tax most of this income at 23%. It is important to consider at which moment you sell the property. It is possible that it will pay you to wait a year, for example.

At first glance, it may seem that the new progressive taxation only affects people with higher incomes, as was the case with the solidarity tax increase. But while the solidarity tax applied only to income from employment and business, the progressive tax rate applies to all income. In the case of, for example, one-off sales, such as the non-exempt sale of real estate or securities, higher taxation may also apply to people with lower regular incomes.

The Czech tax system is not simple and everyone’s tax position is different; it is necessary to take into account a number of different aspects. If you would like to discuss your tax affairs, do not hesitate to contact us, we will be happy to help.