Our tax team has clearly prepared the practical implications of the amendment to the Tax Code in the area of deadlines and sanctions.

Deadline for filing a tax return

We would like to inform you that starting from the 2020 tax period, legislators have decided, through an amendment to the Tax Code, to provide an advantage to those taxpayers (both legal persons and individuals) that will file their income tax returns in electronic form (e.g. via a personal data box) and to extend the deadline for filing tax returns and for tax payments to 4 months from the end of the tax period, i.e. this year until 3 May 2021, compared to the previous 3 months. The period of 3 months from the end of the tax period will continue to apply to those taxpayers who file their tax returns in a hard copy.

Although the provision concerning the above-mentioned change is newly extended in the Tax Code, there is still a provision concerning the extension of the period to 6 months in the case of:

- statutory audit,

- filing by a tax advisor, if a return has not been previously filed (by a taxpayer or advisor) within 3 months.

This amendment brought a positive change in the case of clients represented by tax advisors, namely that the power of attorney for representation by a tax advisor does not need to be delivered to the tax administrator within 3 months from the end of the tax period in order for the period to be extended.

The general 3-month period may be maintained even if the personal and corporate income tax return is filed electronically or by an advisor. In other words, if a tax return is filed for a tax period, e.g. a calendar year, and is filed by the end of 3 months after the end of the tax period, i.e. 1 April, the tax return will be assessed on 1 April, regardless of the method of filing. Such a situation can have a positive impact on a taxpayer if a tax return results in a tax overpayment, and thus the 30-day period for returning the refundable overpayment starts on 1 April.

For this year, the Ministry of Finance has again, through a general pardon forgiving interest on the late payment of taxes and sanctions for late tax returns, in fact, extended the deadline for filing income tax returns. In the case of taxpayers filing tax returns to the tax office in paper form, this so-called “non-sanction period” lasts until 3 May 2021. For taxpayers that file tax returns through their data box, this period lasts until 1 June 2021. However, it is necessary to realize that legally this is not an extension of the time limit, but only a waiver of sanctions. In the event that a taxpayer does not file and pay a tax due even in this non-sanction period, an interest or a sanction will be charged from the date of the regular deadline for filing a tax return, i.e. from 1 April 2021 or 3 May 2021.

It is clear from the general pardon that, for the time being, this measure does not apply to taxpayers who are required by law to have their financial statements audited or to those who file tax returns through a tax advisor, i.e. by 1 July 2021.

Sanctions for late filing and payment of tax

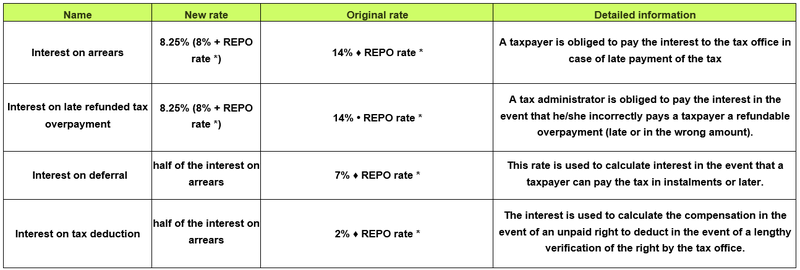

As of 1 January 2021, an amendment to the Tax Code concerning sanctions also came into force. An overview of changes in the amount of interest is reflected in the table below:

Interest will be prescribed if its amount for one type of tax exceeds the sum of CZK 1,000 for one tax period. We would also like to inform you that there is a change in the period for the calculation of interest on arrears. It is now new from the fourth calendar day following the original due date. Thus, the tolerance period is reduced from five to four days, and working days are no longer counted, but only consecutive days.

The sanction for a late tax return remains the same and the amount of the sanction still amounts to a maximum of CZK 300,000. If it is the first offense in a calendar year and the taxpayer is not late for more than 30 days, the sanction is imposed by half. As stated above, the sanction will be imposed only if it amounts to at least CZK 1,000. An important change in this provision is the possibility for a taxpayer to request a waiver of this sanction (Section 259a of the Tax Code). So far, this has not been possible or possible only in specific cases.

For 2020, persons who had a data box and submitted a paper return were obliged to pay a sanction of CZK 2,000. The amendment to the Tax Code reduces this sanction to CZK 1,000 and the sanction applies only to such taxpayers who have a data box compulsorily by law and not to those who have set it up voluntarily. A tax administrator may decide to increase the sanction up to CZK 50,000 if the defects in the filing are not removed by the taxpayer and at the same time, it complicates the tax administration.

If you have additional questions about these changes, do not hesitate to contact us.