Is it necessary to keep your payslips in case you need to prove in the future that you actually worked during a certain period?

Some employees archive their payslips to be able to prove that they were employed in certain time periods, and that compulsory levies were paid to the state institutions – and also that these periods are to be included in the employees’ participation in pension insurance. However, the correct documents to archive are the so-called records of pension insurance (RPIs). These inconspicuous papers are presented to employees once a year and they serve as a basis for the employees’ pensions to be calculated correctly. Sadly, most employees are not familiar with the purpose of these documents, they do not know they should receive them, and few employees retain the records.

When Should Employees Receive the Records?

The statutory deadline for RPIs to be drawn up is the end of April. They must be presented to the employees within the following month, i.e. on May 31 at the latest. The same deadline goes for the RPIs’ submission to the Czech Social Security Administration (CSSA). RPIs can currently only be submitted to the CSSA electronically – via a data box, electronic mailroom, or the CSSA’s ePortál.

If the employment is terminated before December 31, the employer must draw up the RPIs withing one month after the employees’ incomes have been accounted for. Employers typically send the RPIs to their former employees after the final paycheck, together with the certificates of taxable incomes.

Why Are the Records of Pension Insurance So Important?

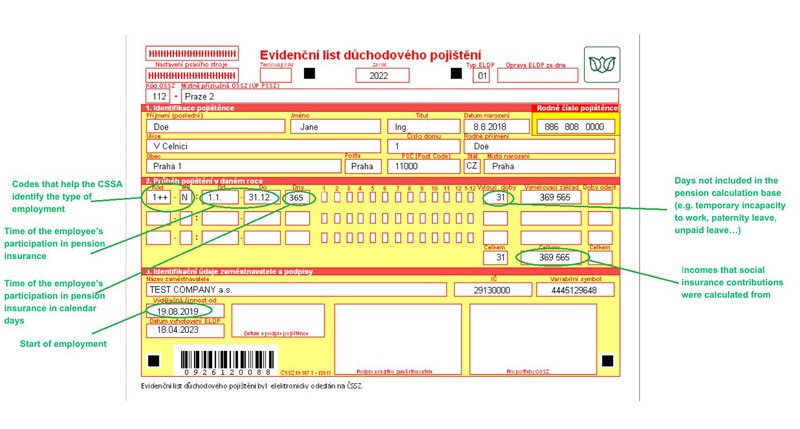

An RPI includes not only the identification data of both the employer and the employee, but also the data needed to assess the employee’s entitlement to receive their pension (i.e., incomes that social security contributions and contributions to the state employment policy were paid from; time of the employee’s participation in pension insurance; excluded periods that are not taken into account when pension is being calculated).

Where To Check the CSSA Has the Necessary Data?

If one of an employee’s RPIs is missing in the CSSA’s records even though the employee was employed by a certain company in the year in question, the CSSA will request the missing RPI from the employer. However, the company might no longer be in existence and the desired records might not be found. When that happens, it is up to the employer to submit their missing RPI.

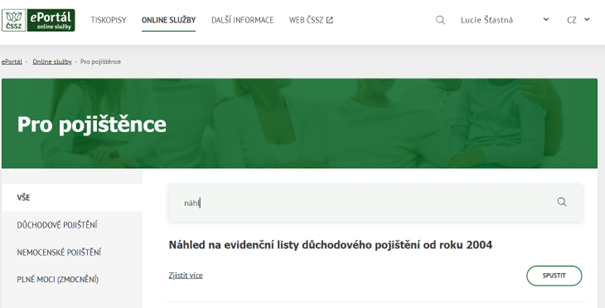

If you know some of your RPIs are missing, go to the CSSA’s website and check your records before calling your (former) employer requesting your RPIs. All insured persons can access their profile via the following link: http://eportal.cssz.cz/.

To log into your account, you need your data box or citizen identity. Then you select Online služby (Online Services) and Pro pojištěnce (For Insured Persons), and after that, you go to Náhled na evidenční listy důchodového pojištění od roku 2004 (View Your RPIs Since 2004).

For older records, you need to open Náhled na informativní osobní list důchodového pojištění (View Your Informative Personal Record of Pensipon Insurance), where you can find your periods of compulsory pension insurance as well as substitute periods of insurance, and also excluded periods and calculation bases since 1986.

And since you will already be browsing your records on the CSSA’s ePortál, I recommend you open Informativní důchodová aplikace (Informative Pension Application) as well – you can use it to look up your estimated old-age pension, how many years and days you have been insured for, and how many more of the 35 years of the required period of insurance you have to work for. As for me, there are at least 25 more to go.

Download PDF: Record of Pension Insurance – Make Sure To Get Your Pension