Every year, there is an increase in the minimum contributions for social security and health insurance due to the rising average wage. This year will be no exception.

However, lawmakers have also prepared another change as part of the consolidation package.

The first change is the increase above in the average wage, which for 2024 has risen from the original 40,324 CZK to 43,967 CZK. This figure affects, among other things, the calculation of the social security and health insurance assessment base.

The second change is the increase in the percentage of the average wage used to determine the minimum assessment base within the consolidation package, which only affects social security. Previously, the minimum assessment base was 25% of the average wage. For 2024, it will move to 30% and in subsequent years by 5% until it reaches 40% of the average wage (in 2026).

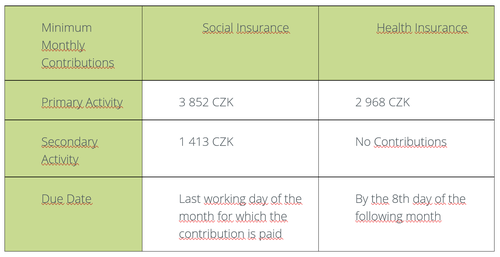

Therefore, the minimum contributions for social insurance are influenced by both changes (average wage and minimum assessment base). For primary activity, this increases from 2,944 CZK to 3,852 CZK; for secondary activity, it goes up to 1,413 CZK.

The minimum contributions for health insurance are only influenced by the average wage. The increase in the minimum contribution is therefore lower, from 2,722 CZK to 2,968 CZK for 2024.

For clarity, we offer the following data valid from January 1, 2024, in a clear table:

Attention! Both new minimum contribution amounts are valid from January 2024; health insurance must be paid by February 8, and social insurance by the end of January 2024. In the past, the new contribution for social insurance was paid only after submitting summaries to the Czech Social Security Administration. Do not forget to update your permanent payments in time to the new rules.

Change in the Assessment Base for Tax

With the amendment to the social insurance law as part of the consolidation package, there is also a change in the assessment base for calculating insurance contributions. This adjustment will affect even those payers who pay higher than the minimum contributions. This is due to the increase in the assessment base from half to 55% of the tax base. The increase applies only to social insurance.

If you have any questions while reading this post, please do not hesitate to contact us.

Download PDF: Changes to minimum advance payments for social security and health insurance