Regulations regarding settlements with tax havens have been part of the TP regulations since 2000. Since then, obligations to document transactions with related entities were indirectly transferred to settlements executed by taxpayers with tax haven-based entities.

At the end of 2020, the legislator took a big step forward by incorporating changes to regulations regarding settlements with tax havens, which entered into force on 1 January 2021. The law introduced: (i) the concept of a transaction other than controlled, which is subject to the obligation to prepare transfer pricing documentation and the (ii) presumption of the seat of the beneficial owner in a tax haven.

Legal background

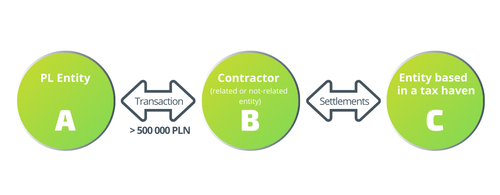

Previously, if taxpayers made settlements exceeding PLN 100 000 with an entity based in the country or in the territory recognized as a tax haven according to the Regulation of the Minister of Finance, they were required to prepare local transfer pricing documentation. Starting from 2021, the obligations to prepare TP documentation were extended to entities that make transactions with an annual value exceeding 500 000 PLN with a contractor who makes direct settlements with an entity based in a tax haven.

The presumption that the beneficial owner of the payment is based in a tax haven

The new regulations introduced a presumption that if the contractor of a local taxpayer (or an entity without legal personality) makes settlements with an entity based in a tax haven, that tax haven entity is the actual owner of payments made. As a result, transactions between such a contractor and a taxpayer should be treated in a similar way as if the taxpayer were conducting transactions directly with a tax haven.

In addition, it is the domestic entity that is obliged to verify the status of the actual payment recipient, whether it is an entity based in a tax haven, and to exercise due diligence in this regard. See a graph illustrating this situation.

Example:

Entity A executed a purchase transaction of goods with contractor B, for an amount exceeding 500 000 PLN per year. Entity B (during the tax year of entity A) makes settlements with entity C in the form of payment of interest and capital installments on loans received. The presumption requires the assumption that the beneficial owner of payment made by entity A towards contractor B is entity C - based in a tax haven. As a result, taxpayer A is required to prepare local tax documentation for transactions with contractor B, unless entity A rebuts the presumption by presenting convincing evidence.

The MF publishes explanations

According to the explanations issued by the Ministry of Finance, it should be noted that the status of our contractor is irrelevant for the presumption. This means that the documentation obligation will arise regardless of whether our contractor is a related or independent entity. It also will not matter whether the contractor is a domestic entity or a foreign entity.

According to the explanations, "settlements with the entity based in a tax haven" should be understood as settling of mutual accounts. Settlement may take various forms e.g. in cash, in-kind, by offsetting mutual receivables and liabilities. The "direction" of the settlements is also irrelevant. Therefore, the presumption will arise regardless of whether the receivables or liabilities are settled.

It should be noted that the term "settlement with an entity based in tax haven" is very broad and should not be considered the same as a transaction. Ministry of Finance explains that the regulations did not define any financial threshold from which it should be considered that the taxpayer's contractor makes settlements with entities based in a tax haven. Thus, the Ministry of Finance recognizes that settlements in any amount (even insignificant, e.g. 100 PLN, 10 USD) mean that the presumption that the beneficial owner of the payment has its seat in a tax haven will apply.

It is possible to rebut the presumption by proving opposite circumstances by demonstrating by the taxpayer that despite settlements with the entity based in a tax haven, the entity based in a tax haven is not the beneficial owner within the meaning of Art. 4a point 29 of the CIT Act.

Exercising due diligence

As part of the explanations, the Ministry of Finance presents solutions that may be used by entities in order to exercise due diligence in determining whether the contractor made settlements with entities based in tax havens. By presenting the standard of expectations towards entities, the Ministry grades the requirements depending on whether the contractor is a related or not-related entity.

In the case of counterparties who are not related entities, it will be sufficient for the entity to obtain a written declaration of knowledge from the contractor, which shows that the contractor does not make any settlements with the entity based in a tax haven. The declaration should be obtained ex-post, i.e. after the end of the taxpayer's tax year.

A higher standard of due diligence is required for transactions with affiliated parties. In the case of related parties, the verification should be wider, as related entities have greater possibilities to cooperate within the group to verify significant circumstances. In such cases, merely obtaining the declaration may be considered insufficient. Additional sources of information obtained from a related entity could be:

- transfer pricing documentation (local file, master file),

- CbC information,

- financial statements along with a report and an opinion of a statutory auditor,

- ownership structure,

- the opinion of a representative of a profession of public trust (e.g. statutory auditor, attorney at law, tax advisor)

If the taxpayer determines, with due diligence, that the contractor does not make any settlements with the entity based in tax havens, it will have the effect of challenging the presumption. As a result, the taxpayer will not be required to prepare local transfer pricing documentation for a transaction made with such a counterparty.

The draft tax explanation is currently at the stage of public consultation. You can submit your suggestions until 20 April 2021.