Regularly like every year, there have been a number of changes in taxes also this year effective from January 1, 2023.

The fundamental changes relate in particular to personal income taxes and the flat-rate regime, value-added tax and road tax. In this article, we bring you the most important of them.

Flat-rate tax regime

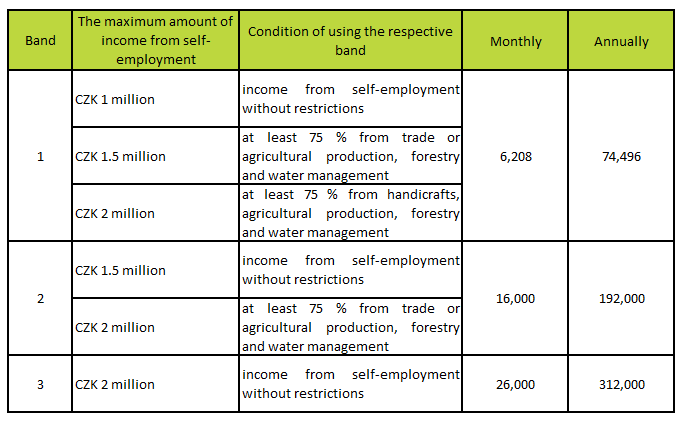

For future taxpayers considering the flat-rate tax regime, an increase in the self-employment income limit for entering the flat-rate regime, which increases to CZK 2 million, may be an advantage. On the other hand, the introduction of three bands based on the level of income and type of business may appear a disadvantage.

- For example, the 1st band with the lowest prepayment can be used by a taxpayer with income up to CZK 1.5 million, provided that 75 % of this income is income to which he could apply a 60 % or 80 % expenditure flat-rate.

- For taxpayers with income from handicrafts or agricultural activities, the limit of the first band is even CZK 2 million. Even here, however, at least 75 % of the income must come from this activity.

Note: It means that a taxpayer in the flat-rate regime who has several types of income to which different expenditure flat-rates can be applied will be required to keep records of income from self-employment for the purpose of proving the amount of qualifying income for the selected band of the flat-rate regime.

For the sake of clarity, we present the following table:

Another advantage of the flat-rate regime is that the limit of additional income (from rent, capital property and other income) is also increased from the original CZK 15,000 to CZK 50,000, which the taxpayer can report without having to leave the flat-rate regime.

Mandatory VAT registration only from 2 million

In connection with the increase in the limit for entry into the flat-rate regime, a long-discussed novelty in the field of VAT was introduced - an increase in the turnover limit for the mandatory registration of a VAT payer to the amount of CZK 2 million. At the same time, the amendment enables the cancellation of registration for taxpayers with a turnover of less than CZK 2 million, and thus allows these taxpayers to register for the flat-rate tax regime.

There was also an extension of the period for submitting the subsequent control report based on the request of the tax administrator to 17 days. The period is calculated from the day the request is delivered to the payer's data box. The payer is allowed to respond to the request at any time within the specified period.

The amendment to the VAT Act also reduces penalties for failure to submit a control report for payers who are natural persons, payers with a quarterly tax period and payers who are limited liability companies with only one natural person partner. These payers will pay half penalties of CZK 5, 15 or 25 thousand in connection with the degree of their wrongdoing in tax administration.

Windfall tax

Following the high growth of energy prices and inflation, a new tax, the so-called Windfall tax - a tax on unexpected profits - will be introduced into our tax system from 2023. The tax application period is the calendar years 2023 to 2025. The tax applies to entities from the listed fields (e.g. energy production and trade or banking).

The tax base is determined as the difference between the compared tax base (current tax base) and the comparative tax base, which is determined as the arithmetic average of the historical tax bases reported in the 4 previous years (i.e. 2018-2021) increased by a 20 % tolerance band. The comparative tax base will not shift in time, i.e. for all years 2023 to 2025, the current tax base will be compared with the average for the years 2018 to 2021. The tax rate for the tax base on windfall profits is 60 %. The tax will be paid in advance from 2023.

Road tax - only for trucks

Both financial and administrative relief is brought by the abolition of a large part of the road tax. Operators of certain types of vehicles, such as cars, buses and trucks with a maximum permissible weight of up to 3.5 tons, are no longer obliged to pay. Even a number of taxpayers operating trucks over 3.5 tonnes will not pay the tax, as it is set at CZK 0 for lower tonnages.

Furthermore, the obligation to pay tax advances for all taxpayers was abolished. In this context, it should be mentioned that as recently as November 2022, the Financial Administration recorded almost CZK 1.5 billion in road tax overpayments, which taxpayers have not yet requested to be refunded. If you're one of them, don't hesitate to ask for overpayments.

Longer period for application of extraordinary depreciation

The extension of the period to apply extraordinary depreciation for property included in the 1st and 2nd depreciation groups can be significantly reflected in the tax bases of taxpayers. These were introduced due to the Covid 19 pandemic for property acquired in 2020 and 2021. The amendment extends this option for another 2 years, i.e. for property acquired until December 31, 2023.

Increasing the limit for progressive tax rate and qualifying income for participating in health insurance

As the limit for a higher tax rate depends on the amount of the average wage, qualifying income above CZK 1,867,728 was subject to a 23% tax rate for 2022, for 2023 it will be income above CZK 1,935,552. Lower income is taxed at 15 %.

Furthermore, in connection with the annual announcement of an increased average wage, there was a change in the amount of qualifying income for participation in health insurance. The so-called qualifying income, i.e. the minimum amount of the agreed income for participating in health insurance, will increase from the original CZK 3,500 to CZK 4,000 per month as of January 1, 2023. What does it mean for taxpayers? If, for example, you have an income of less than CZK 4,000 per month based on an agreement to perform work, you do not deduct social and health insurance from this income, and the income is subject to a 15% withholding tax in the case of an unsigned tax declaration.

Change in the limits for the mandatory filing of a tax return

As of January, the income limit from which it is mandatory to submit a tax return for the income tax of natural persons is also changing. The limit for annual income has increased from CZK 15,000 to CZK 50,000. Taxpayers who, in addition to income from employment, have additional income (e.g. rent, sale of shares, etc.) will submit a tax return if these additional incomes are higher than CZK 20,000, instead of the current CZK 6,000. Note that these limits only apply to the submission of tax returns for 2023, i.e. submissions made in 2024.

EET abolished

As expected, the law governing the obligation to register sales (EET) was officially abolished as of January 1, 2023. The EET system will therefore no longer be operated, so it will not be possible to send information about sales even voluntarily.

Mandatory data boxes

Last but not least, it should be mentioned that starting this year, a number of entities will have a mandatorily set up data box. This includes, among others, natural persons who are entrepreneurs, or legal entities not established for the purpose of business, etc. Note that all tax entities that have an established data box are legally required to submit forms (especially tax returns) only electronically. The Financial Administration will only communicate with these persons through the data box.

Download PDF: Tax news for 2023