Overview of important deadlines and major news for 2024.

Maximum Assessment Base for 2024

As of January 1, 2024, gross income subject to social security contributions is 2,110,416 CZK.

Effective from January 1, 2024, there newly is an obligation to pay sickness insurance contributions even for employees, who were previously only subject to pension insurance contributions. The total insurance rate for employees is 7.1% from January 1, 2024 (6.5% for pension insurance and 0.6% for sickness insurance). For employers, the insurance rate remains 24.8%.

Changes in Agreements to Complete a Job/to Perform Work

Some changes in work agreement rules came into effect on October 1, 2023, mainly in working-time record keeping and bonuses. The most significant change from January 1, 2024, is the new entitlement to employees’ leave of absence according to the number of completed shifts. All provisions relating to leave for employees in an employment relationship now apply to work-agreement employees as well. The essential condition for leave entitlement is the duration of the agreement of at least four weeks and 80 working hours. For determining the leave extent, the so-called fictitious working time (fiktivní pracovní doba) is introduced, amounting to 20 hours per week.

Employees working based on agreements to complete a job will be obliged to pay sickness insurance contributions from July 1, 2024, if their income from all agreements with one employer exceeds 25% of the average wage (10,500 CZK in 2024) or 40% of the average wage (17,500 CZK in 2024) from all agreements with multiple employers. In the case of agreements with multiple employers, the employee will pay the social security contribution of 7.1%, while their employer will be obliged to pay their health insurance contributions. However, changes in this area are expected, and we will inform you about them if necessary.

Electronic Delivery of Documents

Documents listed in the paragraph 334 of the Labor Code must still be delivered directly to their addressee. Typically, these are unilateral legal acts such as the termination of employment.

All other labor-law documents must be delivered in writing, but not necessarily directly to their addressee, and the precise rules regarding document signing are stated in paragraph 21 of the Labor Code.

Limit for Progressive Tax Payment (23% Rate) for 2024

The maximum assessment base of social security insurance no longer affects the taxation of personal income. According to the approved recovery tax package, incomes exceeding 1,582,812 CZK per year (131,901 CZK per month) will be subject to a higher tax rate of 23%, while incomes below this limit will be taxed at a 15% rate. This represents a significant reduction of the limit, and the obligation to pay higher tax will therefore affect a larger number of employees.

Abolition of Student and Other Tax Rebates

From January 1, 2024, the student tax rebate of 335 CZK per month is abolished. Simultaneously, the rebate for children attending pre-school is abolished, and the rebate for spouses is now conditional on whether the spouse cares for a child under 3 years of age. The deduction from the tax base for exams verifying the results of further education and the deduction of the contributions paid to a trade union are also abolished. For deductions applied on an annual basis, this will be applied for the first time for the tax calculation for 2024.

Meal Allowance

Monetary contribution for meals for one shift is tax-exempt (and thus also exempt from insurance contributions) for employees up to 70% of the upper limit of the meal allowance for a business trip lasting 5 to 12 hours set for employees remunerated with a salary, i.e. employees mentioned in paragraph 109, subsection 3, of the Labor Code.

From January 1, 2024, this amount will be 116.20 CZK (70% of 166 CZK). This limit now also applies to meal allowance provided in a non-monetary form, typically as paper meal vouchers or meal voucher cards. Any amount above this limit is considered employees‘ non-monetary income and is subject to all due levies.

Further Employee-Benefit Changes

Based on the approved recovery tax package, there are significant changes in the area of non-monetary benefits. A new annual limit for the provision of these benefits is set at half the average wage, which is 21,983.50 CZK for 2024.

This amount does not include meal allowances, contributions for education arranged by the employer (i.e. professional training, language courses necessary for work) and contributions to life and pension insurance up to a total of 50,000 CZK per year.

Other non-monetary benefits above the state-established annual limit are considered taxable income and thus subject to all levies (tax, social and health insurance) in the case of both employers and employees.

We would like to point out that the sale of goods by employers (and their purchase by employees at a reduced price) or the provision of services by them (e.g. accommodation of their employees in facilities run by them at a reduced price) are also considered employee benefits, to the extent of the difference between the price paid by the employee and the standard price. For example, if you provide your employee with free accommodation in your hotel, the value of the non-monetary benefit equals the price that a regular customer would pay for this kind of stay. This price should then be included in the annual limit.

Minimum Wage

For 2024, the minimum wage for a 40-hour work week is set at 18,900 CZK per month and 112.50 CZK per hour. That equals to the minimum assessment base for 2024. The minimum health insurance contribution amounts to 2,552 CZK.

Guaranteed Wage (zaručená mzda)

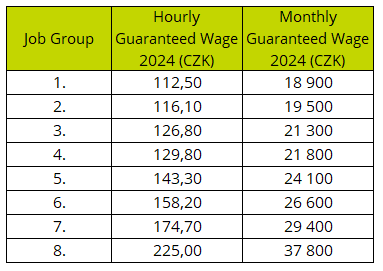

Employees in an employment relationship, whose wages are not agreed upon in a collective agreement, are protected from receiving overly low wages by the so-called guaranteed wage. The work performed is graded into eight individual groups, according to its complexity, strain, and responsibility of the employee who performs it, with the lowest guaranteed wage established for each group. Therefore, employers are not only obliged to pay the minimum wage to their employees, but also to remunerate at least the relevant groups with the respective lowest guaranteed wage. However, for 2024, there will only be a wage increase for groups 1–3 and 8.

Similarly to the minimum wage, the lowest levels of guaranteed wage are determined both hourly and monthly, and just as a wage lower than the minimum wage, a wage lower than the guaranteed wage must be compensated. Therefore, the pays for overtime, holiday, night work, work in a difficult environment, and work on Saturdays and Sundays are not included in the wage.

Download PDF: LEGISLATIVE CHANGES IN WAGES FOR 2024