Poland, Slovakia, the Czech Republic, and Hungary are key CEE countries, attracting investments from all over the world. And although one would expect that it would be Poland – the biggest economy, country, and nation among CEE countries – who will excel, yet it seems that foreign investors prefer rather Slovakian, Czech or Hungarian economy. Surely it is not purely a coincidence.

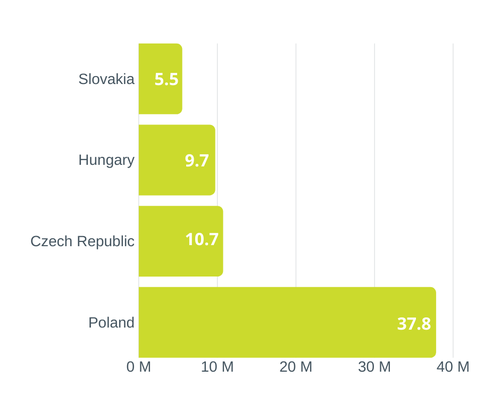

Population / 2020

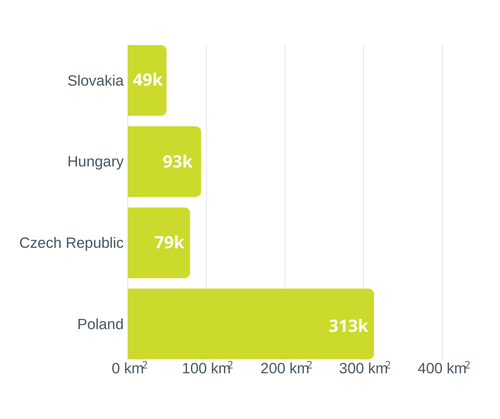

Area

Poland’s population is 3,5 times of Czech Republic, 4 times of Hungary and almost 7 times of Slovakia. The area of these countries has a similar proportion.

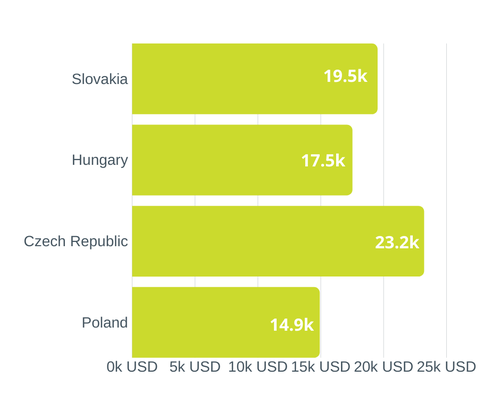

GDP per capita / 2019

Slovakia, Hungary and the Czech Republic are significantly richer than Poland. Disposable income is higher in these countries. Therefore, their economy is relatively stronger boosted by individual consumption. As a result, there are ultimately more public funds to be disposed of and invested in order to effectively attract investors. Plus less funds need to be spent to help poorer people.

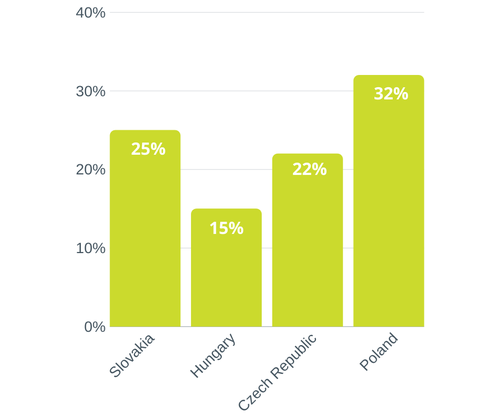

Marginal PIT rates / 2020

Despite the fact that the disposable income of Poles is at the bottom, the Polish government applies the highest marginal personal income taxation – 32%. This has a negative effect on individual consumption. Moreover, there are other charges imposed by the Polish government – do not forget about social security and health insurance contributions. Additionally, in case of HNWIs (annual income exceeding PLN 1M), an additional 4% solidarity charge is imposed. Combined, even 40% is taken from the individual’s gross income.

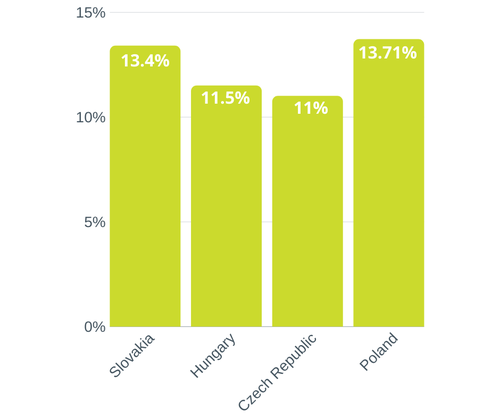

Marginal employee’s social security charges / 2020

Again, Poland has the highest marginal social security contributions. Additionally, there is also a health insurance contribution imposed at 9%, whereby 7,75% of the basis is tax-deductible.

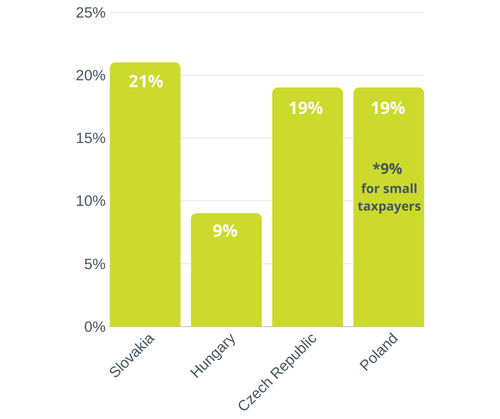

General CIT rate / 2020

At first sight, it looks like the level of CIT burden is similar between our countries. However, when you go into the details, you will notice that Hungary, Slovakia, and the Czech Republic introduced R&D / IP-Box regimes a long time ago, whereby reasonable Polish provisions were implemented only a few years ago. But the most important difference from the Polish tax system attracting the investors is local participation exemption in the Czech Republic, Hungary, and Slovakia. This instrument allows to reinvest profits generated in these countries without tax leakage upon the sale of shares in subsidiaries. This is why you see most of the automotive industries from the CEE region located in Slovakia, Hungary, and the Czech Republic, and only a few in Poland.

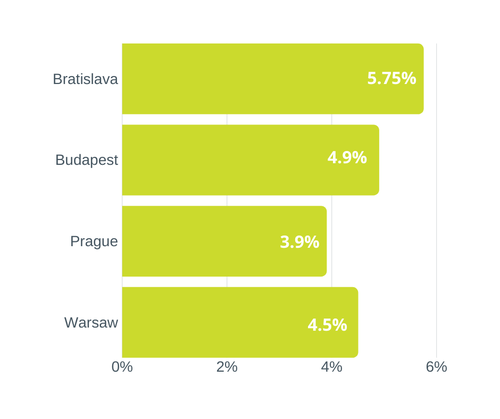

Prime office yield / 2019Q3

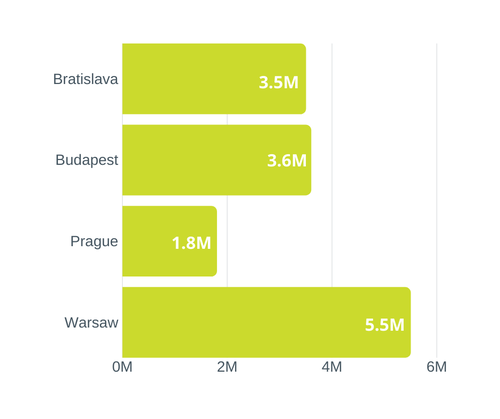

Offices – sqm available / 2018

Yield realized in capital cities of Poland, Hungary, and the Czech Republic are on a similar level, whereby yields derived in Bratislava are significantly higher. However, due to the relatively largest amount of space that may be allotted to real estate development, it seems that it is the Polish real estate market that has the highest potential. In this context, instead of introducing very restrictive WHT provisions which already are scarring the investors out, the Polish government should take the example of effective legislation and business-minded approach from its Czech, Hungarian and Slovakian colleagues to boost the Polish economy, especially in these uncertain times.

Łukasz Bączyk

Head of Tax

E: lbaczyk@asbgroup.eu

Jarosław Szajkowski

Tax Manager - Tax Adviser

E: jszajkowski@asbgroup.eu

Marta Skrodzka

Tax Manager - Tax Adviser

E: mskrodzka@asbgroup.eu

Piotr Szeliga

Tax Manager - Tax Adviser

E: pszeliga@asbgroup.eu

Paweł Jóźwik

Tax Manager - Attorney-at-law

E: pjozwik@asbgroup.eu