On 27 July 2021, a new Act No. 285/2021 Coll. was published in the Collection of Laws, which primarily amends the Act on State Social Support and the Income Tax Act.

The amendment to the second of these laws brings the following changes in the area of tax allowances for children.

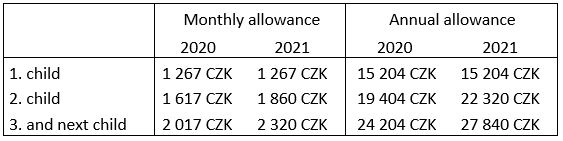

Particularly, it is an increase in the tax allowance for the second, third, and next child. The increase in individual allowances from both a monthly and an annual point of view is shown in the overview below:

Given that the tax advantage changed during the current tax period, the question arose as to how to cope with these changes. Based on the wording of the transitional provision, the increase in the tax benefit for children for income from the dependent activity will be applied only after the end of the 2021 tax period.

This means that nothing will change in the course of 2021 for employees who claim a child tax benefit from their employer on a monthly basis. When processing wages for the remaining part of 2021, and at the same time when calculating the advance on personal income tax from dependent activity, such a tax advantage will be provided for children, which was valid before the amendment to the Income Tax Act.

The increase in the amounts of the tax benefit for the second, third, and next child will be reflected by the employer only after the end of the tax period, in the annual tax reconciliation of individual employees who were entitled to this allowance during the year. In the event that employees file a tax return for personal income tax for the year 2021, they will apply the increase in the amount of the tax allowance to the second, third, and next child when filing the tax return.

The change in the tax allowance for the second and third children is supplemented in this amendment by the abolition of the maximum limit for the payment of a monthly bonus per child in the amount of CZK 5,025. However, it follows from the transitional provision of the published amendment that the abolition of the limit will be applied for the first time only when calculating the tax advance in January 2022, ie for the 2022 tax period.

Employers in 2021 still apply that they cannot pay more than CZK 5,025 in the monthly tax bonus.