Have you noticed that your pay in months you take a vacation in differs from months you work full time?

The difference is caused by the fact that you do not receive standard pay for your vacation, but the so-called pay compensation.

What Is Pay Compensation?

There are several types of pay compensations: illness compensation, vacation compensation, national holiday compensation, and obstacles-to-work compensation. We will have a more detailed look at the vacation compensation.

Vacation compensation is calculated using the average hourly earnings, determined by your income and hours of work in the previous calendar quarter. If you did not work a minimum f 21 shifts in the previous quarter, the so-called probable hourly earnings will be determined.

Does this mean that if you receive an annual bonus in March, your vacation pay compensation will be significantly higher than it normally would be in the following quarter & that it is therefore convenient for you to take a long vacation? The answer is NO. Bonuses (and other pay components for periods exceeding 3 months) are divided proportionally into the average hourly earnings, which means that an annual bonus will be divided into the following four quarters.

However, a bonus received for e.g. a good job performance in a certain month will only increase your average hourly earnings for the following quarter.

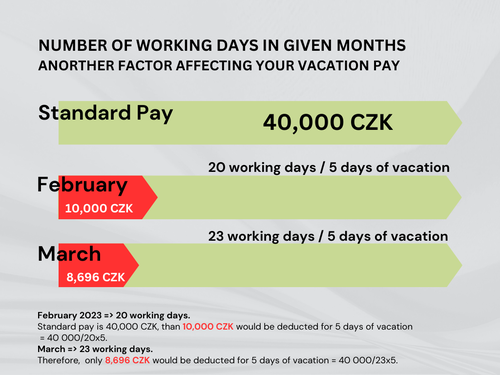

Number of Working Days in Given Months as Anorther Factor Affecting Your Vacation Pay

It is not only the vacation compensation based on the average hourly earnings that determines your pay in given months. It is also important to note that each month is comprised of a different number of working days. The fewer working days there are, the more of your standard pay will be consumed by your vacation.

To make this easier to understand, let’s have a look at February 2023, which was comprised of 20 working days. If your standard pay is 40,000 CZK, then 10,000 CZK would be deducted for 5 days of vacation (40,000/20x5). However, March 2023 was comprised of 23 working days, and therefore, only 8,696 CZK would be deducted for 5 days of vacation (40,000/23x5).

But, as previously mentioned, you will of course receive pay compensation for your vacation.

Now you know why your pay varies from month to month, even though your contractual pay has remained the same and other pay components have not changed either. If there is anything else on your payslip that you do not understand, let us know and maybe we can address it on the next Payroll Friday.

Download PDF: How Taking a Vacation Affects Your Pay