The Ministry of Finance* (MF) is not slowing down in carrying out work aimed, as declared, at more effective prevention of understatement of taxable income in the area of transfer pricing. Changes in TP introduced shortly before the end of the year are unfortunately becoming a tradition.

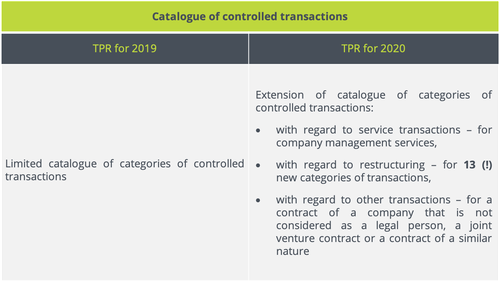

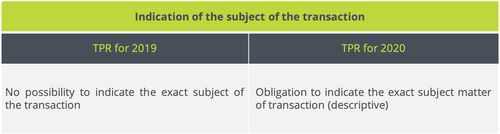

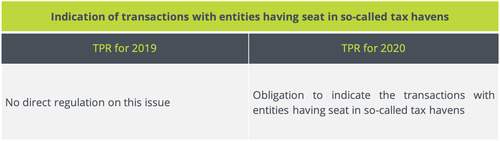

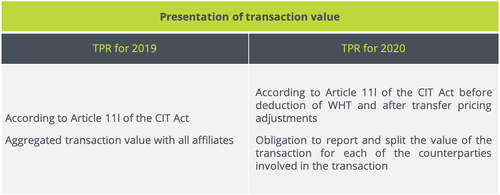

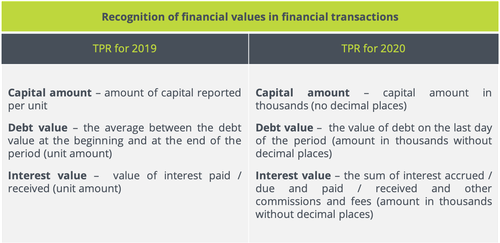

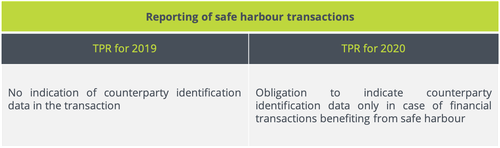

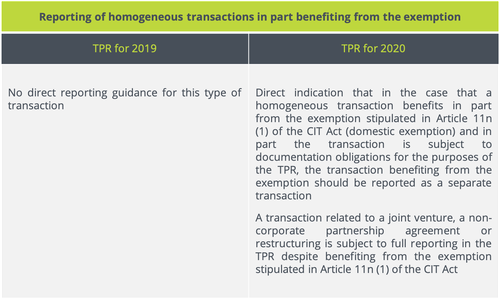

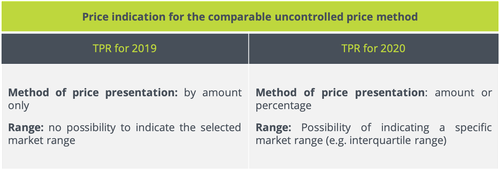

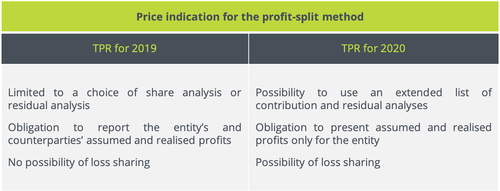

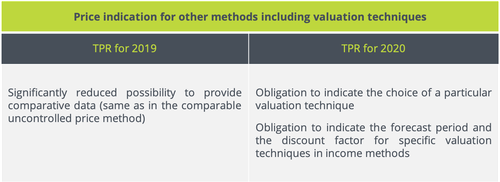

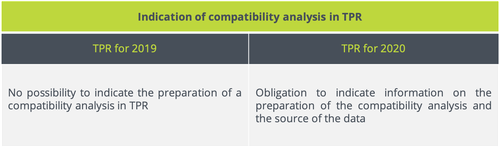

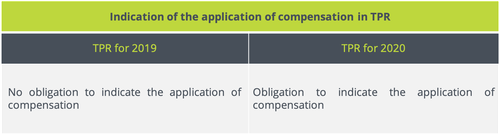

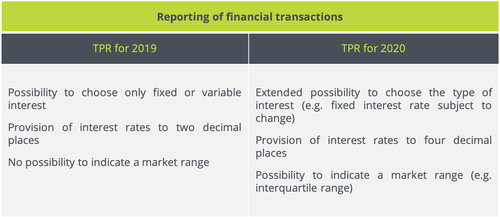

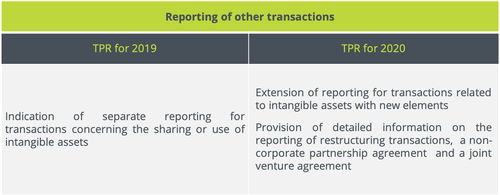

This time, taxpayers filing transfer pricing information (TPR-C) for 2020 will have to include additional parameters in the TPR-C form that were not included in the form filed for 2019. Most of the changes will lead to a more thorough review of: (i) adopted rules for the delineation of types of transactions executed with affiliates, (ii) calculation of the value of reported transactions, (iii) benchmarking analyses prepared.

As of now, the MF has not shared information on when the release date of the final version of the TPR-C form under the amended regulation. We provide an analysis of the key changes between TPR-C form for 2019 and 2020 in the table below.

* We have summarised the presented changes on the basis of the Regulation of the Minister of Finance, Funds and Regional Policy of 18 December 2020 amending the Regulation on transfer pricing information with respect to corporate income tax. Analogous changes have been introduced in case of the transfer pricing information provided by personal income taxpayers.

Should you have questions, please contact our experts:

Piotr Szeliga

Tax Manager - Tax Adviser

E: pszeliga@asbgroup.eu

Łukasz Komorowski

Senior Tax Consultant

E: lkomorowski@asbgroup.eu