When we start a new job, most of us look forward to our first paycheck but are also curious about our paycheck.

What to focus on when you first get your hands on it? The payroll may seem like an incomprehensible table that can take many forms. What are its mandatory requirements? And why not keep it?

The payslip must include details of the various components of salary, salary, or deductions made. It must have your name and employer's name on it. Your basic wage, your health insurance, and your holiday entitlement are listed.

On the payslip, pay attention to the listed health insurance company. When you change it, check that the change has taken place since that month. It happens that employees discover after a year that the employer registers a completely different health insurance company because the employee forgot to report it.

The holiday balance is also noteworthy. The amendment to labor law which the holiday from 2021 gives the employer the obligation to register the holiday entitlement in hours. This may be confusing for workers, but this amendment has made it fairer for workers to take leave during uneven working hours. The internet has lots of calculators to recalculate it. But you will always need to know how many weeks you worked in a given year, your hourly hours per week, and how many weeks of annual leave you are entitled to (according to your employment contract). After working 4 weeks, you are entitled to 1/52th day of leave for each week worked.

You don't need to verify your social and health insurance calculation, but check the amount of the tax credit. The basic discount per taxpayer is CZK 2.320. Other discounts are for study (CZK 335), disability (CZK 210, CZK 420 or CZK 1.345), and tax benefits (1st child CZK 1267, 2nd child CZK 1.617 and 3rd and every other child CZK 2.017). Check the number of discounts during the month when you have a new child. If you can't get your payroll billing on time, you won't miss the rebate. It will be returned to you as part of your annual settlement or tax return.

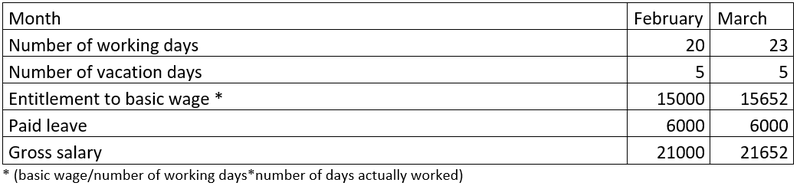

The most common query from workers is when they take leave and wonder about the level of basic pay. This is due to the varying number of working days per month. Below you can see a table with a simple example.

The employee has a basic wage of CZK 20,000. He took five vacation days in February and March as well. He was entitled to CZK 6,000 for 5 days of leave.

Thus, in a month that has a higher number of working days, the employee will receive more on the basic wage than in a month that has fewer working days. In our example, the employee even received 1.652 in March, - more.

What about archiving paychecks? You may need the last three payslips for the bank. But you can always ask your employer for confirmation of your salary. A 5-year-old payslip won't do you any good. What you need to archive from your employer is a pension insurance record sheet, which you will receive mostly in the spring for the previous year and when you leave your employer. It's good when you change employers to check your home drawer to see if you have them all. If you subsequently lose contact with your employer, you may then find out in 10 years that it no longer exists. This can only be a problem if you apply for a pension and the Czech Social Security Administration will require a pension insurance record sheet for the last 30 years.