If you have sold or have considered selling a house or an apartment but you are not sure about the taxes.

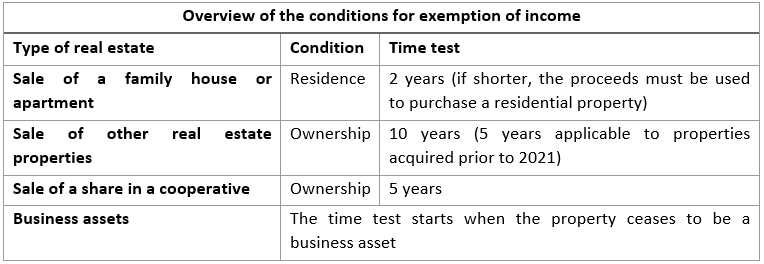

Selling a real property generates income that is, generally, subject to the income tax of natural persons. However, this income may be, under certain conditions, exempt from tax. These conditions vary depending on the type of real estate and the specific circumstances and are specified in the Income Taxes Act (“ITA”).

Sale of a family house or an apartment

Income from the sale of a family house or an apartment is subject to a two-year time test. If you lived in the family house or apartment for at least two years, income from the sale of the these properties and associated blocks will be exempt. The apartment, however, must not comprise non-residential premises (with the exception of a garage, cellar and storeroom).

If you lived in the property and failed the two-year time test but you use the proceeds from the sale to purchase residential property, the income from the sale of that property will also be exempt. Residential property includes but is not limited to the purchase and construction of a family house or an apartment and purchase of a block of land, provided that construction of the residential property begins within 4 years from the date of the loan agreement or purchase of the block of land.

What if the owner of the house and the owner the land are two different people? Then, if the owner of the house purchases the land from the other owner, a new period of two years commences from the date of acquisition of the land.

Sale of other real properties

For other real estate properties which are not eligible for exemption under the previous section, a longer time test is applied. When these properties are sold, it is not important whether the seller had a place of residence there or not; the exemption is assessed based on the time for which the seller owned the property.

By the end of 2020, a five-year time test was being applied in such cases. For example, if you bought an apartment which you were renting and then you sold it after 5 years, the income from sale was exempt from tax. With the amendment to the Income Taxes Act, the time test has now been increased to 10 years. Let us keep in mind, however, that the extended time test applies only to properties acquired after 1 January 2021, so if you already own such an apartment or a house and consider selling it, the five-year test will still apply.

If you inherited a real estate property and want to sell it, the time test of 5 or, as the case may be, 10 years will be reduced by the time over which the real estate property was owned by the decedent (i.e. the person from whom you have inherited the property). In this case, the decedent must have been a relative in the direct line or the spouse (parents, grandparents, etc.).

Sale of a share in a business corporation or what’s the story with housing co-op apartments

There is yet another type of exemption – exemption of income from sale of a share in a business corporation. The sale of a share in a cooperative, i.e. a “housing co-op apartment”, is defined under this concept as well. Income from the sale of a share in a cooperative is exempt after 5 years from the acquisition. (The time test does not get extended by the amendment in this case.) Just as in the previous case, the time test gets reduced by the time over which the property was owned by the decedent.

Business assets

What if the apartment or the house was part of your business assets, i.e. you used it for your business activities? Sale of real properties classified as business assets is subject to tax as part of self-employment (ITA, Section 7). The time test (5 or 10 years) for exemption does not start until the property ceases to be a business asset.

What if the sale is not exempt?

If the conditions for exemption are not met, the profit (the income minus costs of acquisition of the real estate), if any, must be subject to tax and reported as other income in your tax return (ITA, Section 10). The advantage is that no health or social insurance premium is payable from such income. Apart from the acquisition price of the property, costs of repairs and maintenance as well as other expenses associated with the sale (e.g. fees for legal services) may be included in the deductible costs. If you acquired the property by inheritance, the price of the property determined by an expert will be reported in your tax return.

The amendment of the Income Taxes Act has introduced a new progressive tax with two rates, 15% and 23%, effective as of 2021. The increased rate is applied to any taxpayer’s income exceeding CZK 1,701,168.00 per calendar year. Different from the increase in the solidarity tax which was applied only to income from employment and income from self-employment, the progressive tax rate applies to the entire tax base, including income from the sale of real estate.

Deduction of interest from the tax base

Yet another recent change has come into effect as of 2021 in respect to real properties. The maximum amount of interest from building savings or a mortgage used for financing the purchase of a residential property that may be deducted from the tax base is being reduced from CZK 300,000.00 to CZK 150,000.00 per calendar year.

In order to assess which deduction amount to apply, the relevant date is not the date of the loan agreement but is rather the date when the residential property financed from the relevant loan was purchased. (For example, if you purchased a property, the date of entry of your ownership right into the Cadastral Register will apply.) If you acquired an apartment or a house financed by a mortgage by 31st December 2020, you will still be able to reduce your tax base by interest up to CZK 300,000.00.

Finally, please remember that the conditions for exemption may often be unclear in various circumstances. We will be happy to help with any inquiries you might have or also with preparing your tax return.