The exemption of income from the sale of shares in companies and securities will undergo a significant restriction according to the proposed amendment to the Income Tax Act.

The current wording allows the exemption of income from the sale of shares in business corporations, except for income from the transfer of securities, if the period between their acquisition and sale exceeds 5 years. For income from the transfer of securities, this period is 3 years. The aforementioned periods can be reduced, for example, by the time the legator, who was a direct relative or spouse, held the share or security. For securities, the exemption can also be applied before fulfilling the time test if the total of these incomes does not exceed CZK 100,000 in the tax period.

With anticipated effectiveness from January 1, 2024, however, the exemption of income from the sale of shares and securities will be limited to an absolute amount of CZK 40 million, with both incomes being added together for these purposes. Beyond the time test, another restriction will be added in the form of an absolute amount of the exempted portion.

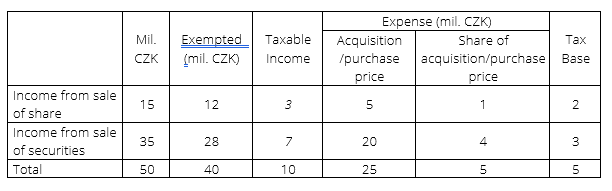

It will be interesting to see how the amount of exemption is determined if the taxpayer receives both incomes from the transfer of shares and securities, as the legislator presents us with an interesting mathematical exercise in this regard.

The portion of income that cannot be exempted will be taxed as other income (Section 10 of the Income Tax Act), with the taxpayer being able to apply expenses to these incomes. Since these incomes are only partially subject to income tax, expenses can also be applied partially, proportionally. Expenditures incurred are always applied separately to each type of income. Again, it is necessary to distinguish expenses related to income from the sale of securities and those from the sale of shares in a business corporation.

Moreover, it will continue to be true that expenses can only be applied up to the amount of income; therefore, the seller cannot report a tax loss, but the possibility of compensating losses within each type of income remains the same.

The calculation procedure will probably be as follows:

- First, the share of exempted individual types of income is determined.

- Next, the share of applicable expenses is similarly calculated.

- The calculation of the tax base can be illustrated with the following example. The share of exempted income out of the total is 80%. Thus, only 20% of each type of income is subject to taxation. The acquisition or purchase price can be applied as an expense, but again, only at 20%.

- The resulting tax base will be at the amount of 5.

During the comment procedure, the question of a transition period between the old and new legal regulations was also discussed. It is necessary to realize that many trades concluded not only this year but also in previous years may not yet be fully settled (e.g. payments in instalments). A suitable solution needed to be found for these cases. Contrary to expectations, the legislator did not apply a standard transitional provision but modified the procedure directly in the law.

If it is not possible to apply the exemption from tax due to exceeding the legal limit for exemption, and the share or security was acquired before 1.1.2024, the taxpayer can, instead of the acquisition price, apply the market value of the transferred asset as an expense, determined by an expert as of 31.12.2024, regardless of when the sale took place. It is necessary to note that in the original government proposal, the milestone was set at the end of 2023. However, an amendment moved it by one year to 31.12.2024.

If the law is adopted in this form, partners or shareholders will be able to use, for sales realized until the end of 2024, the market price of the share or security sold, determined by an expert at the date of sale, as an expense. It can be assumed that the expert valuation will be very close to the sale price, and the tax base from these sales will be CZK 0.

Last but not least, it is necessary to note that from 2021, a so-called progressive taxation of income applies to natural persons, meaning that incomes above a certain limit are taxed at a higher rate. The consolidation package reduces this limit to 36 times the average annual salary. It can easily happen that incomes from the sale of business shares and securities that do not meet the exemption limit will be partially or fully taxed at a 23% rate.

Calculating the exempted share or applicable expense may become more complicated if part of the income does not meet the time test for exemption. This especially concerns shares in LLCs if there has been a gradual increase in the share, acquiring shares from other partners, or non-cash contributions.

If you are currently dealing with the sale of your share or securities, do not hesitate to contact us, as the saying goes, "He who is prepared is never surprised."

Download PDF: EXEMPTION OF INCOME FROM THE SALE OF SHARES AND SECURITIES