The introduction of e-invoicing is one of the elements of the European Commission’s proposals for changes presented in the document "VAT in digital age", which will allow for the digitization of VAT settlements and adapt the regulations to contemporary realities.

European rules on electronic invoicing are being implemented in further EU Member States.

E-invoicing provides a fast, secure and efficient way for businesses to send and receive invoices, as well as benefits for governments and European administrations in the form of real-time reporting, financial control as well as the reduction of tax evasion, and standardisation of reporting.

Countries that have already introduced national e-invoicing systems as their undoubted advantages indicate, for instance, increasing the efficiency of companies, reducing costs, reducing manual work, increasing the quality of real-time cash flow forecasts, reducing the VAT gap and optimizing taxpayers settlements.

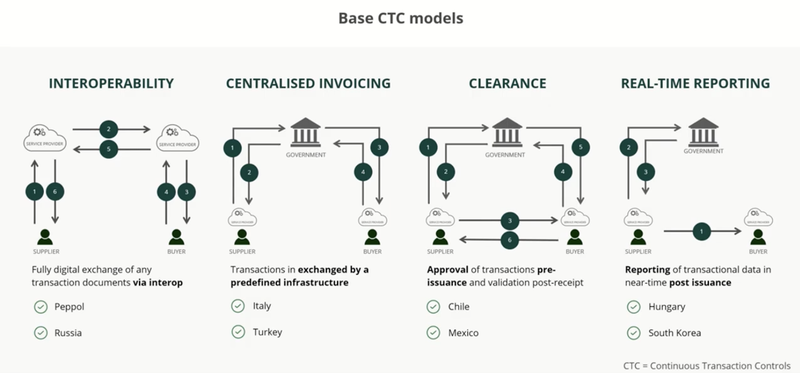

There are a few possible models to supply the E-invoices to the tax authorities and ways of keeping communication between parties involved in the process. Below can be seen the examples from different countries.

How e-invoices looks like in selected Member States?

Italy

Italy is considered (alongside the Scandinavian countries) to be a pioneer in the field of electronic invoices, being one of the first EU countries to implement widespread real-time invoice reporting in B2B and B2G transactions even before the European Directive 2014/55/EU (a directive establishing mandatory receipt of e-invoices for public administrations) came into force.

From 1 January 2019, e-invoicing is mandatory for B2B and B2C among Italian operators with an annual turnover of more than EUR 65,000.

The Italian electronic invoicing system is called SID (Sistema di Interscambio), the system processes electronic invoices and verifies e-invoices before transmitting them to public entities. An e-invoice to government authorities can be sent via:

- certified e-mail (CEM);

- Tax Office website where appropriate authentication is required;

- SDICoop - network service;

- SDIFTP - file transfer protocol (technical data).

Each method has corresponding requirements regarding the technical aspects of the documents to be uploaded as well as the method of connection to the platform.

Most taxpayers use the support of IT solution providers.

Business entities send the e-invoices in the appropriate format via the SID, which delivers each document to the state administration based on the unique identifier of the addressee.

All invoices are forwarded to the relevant department to carry out appropriate checks. The Italian government authorities archive the submitted e-invoices for 10 years - the SID system does not archive invoices.

The number of e-invoices delivered to the system is 30 million per year.

The Italian state authorities have also developed a dedicated smartphone app that allows small and medium-sized enterprises (SME) to create and send e-invoices.

Spain

The tax authorities in Spain introduced so-called real-time invoicing in July 2017. E-invoices must be sent via a special tax authority website in an XML file. The so-called SII is mandatory for large companies and VAT groups, among others, while entities not obliged to use the SII can use the system voluntarily. The national system dedicated to e-invoicing processes more than 12 million e-invoices per year, providing significant savings for the public and private sector through the use of a fully automated invoicing process.

Slovakia

In Slovakia, a law specifying e-invoicing requirements for public administration and its suppliers has been in force since of August 2019. It obliges a public supplier to issue an e-invoice if the value of the invoice is greater than EUR 5,000.

Currently, the use of e-invoicing in Slovakia, as in Poland in the private sector, is voluntary. As the Electronic Invoicing Information System (IS EFA) is developed and tested, the mandatory real-time reporting obligation will be extended probably in 2024.

Romania

Mandatory e-invoicing from July 2022 has covered the companies which activities are related to goods or areas considered to be particularly vulnerable to tax evasion - categories such as fruit and vegetables, alcohol, construction, clothing and footwear, for example, have been identified. The obligation to e-invoice via the national system is also mandatory for B2G transactions.

For other entities, the implementation of electronic invoicing will be mandatory from 2024.

Invoices will be mandatory generated in the appropriate XML format in accordance with a specific standard in a dedicated government system.

Issuers and recipients are required to store electronic invoices for at least 10 years.

What’s next?

Further Member States such as France and Germany, are planning to implement e-invoices from 2024.

Moreover, European Commission is planning to implement mandatory E-invoicing as of 2028 which means that sooner or later all EU countries must include e-invoicing in their local tax jurisdictions.

Worth keeping in mind that in Poland in 2023 the National E-invoice System so-called KSeF for taxpayers is optional, while probably from July 1, 2024 it will become mandatory for companies with their registered head office or fixed establishment of business in Poland.