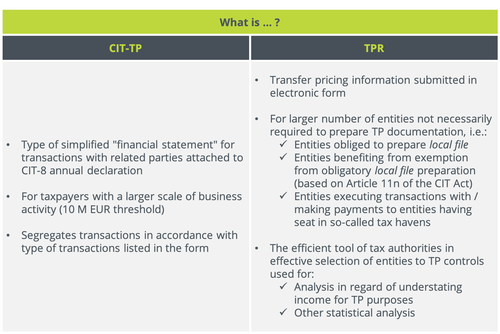

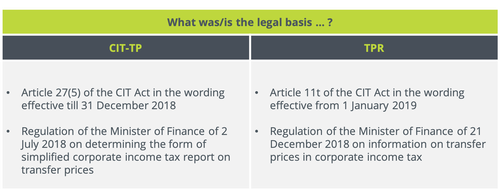

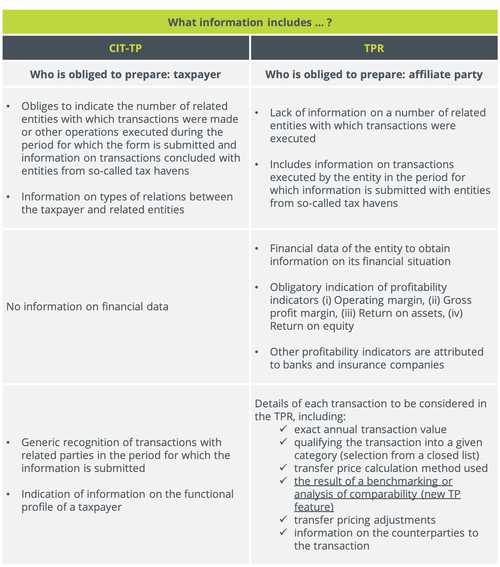

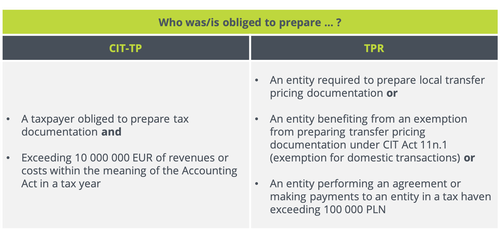

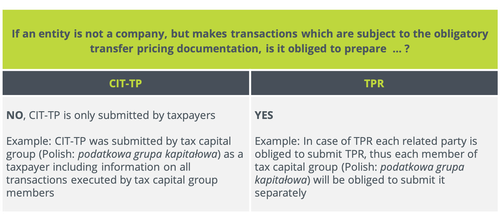

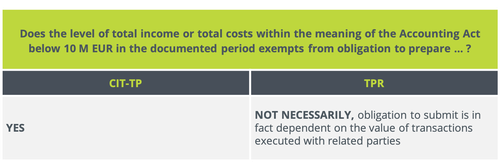

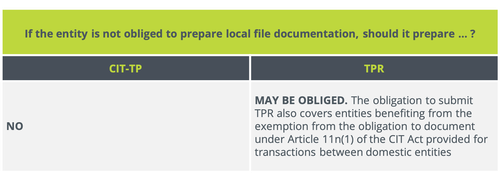

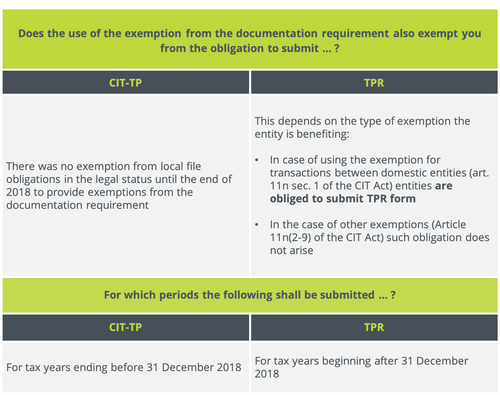

The purpose of this publication is to summarize basic differences between CIT-TP form (submitted by larger taxpayers in recent years) and its new equivalent – TPR form. A wider range of related parties will be required to submit the TPR form. In the publication, we compare the two forms based on regulations of the Corporate Income Tax Act. However, due to analogic regulations in the Personal Income Tax Act, this study should prove helpful also for PIT taxpayers, e.g. shareholders of tax transparent entities such as Polish limited liability partnership – spółka komandytowa.

Should you have questions, please contact our tax experts:

Łukasz Bączyk

Head of Tax

E: lbaczyk@asbgroup.eu

Marta Skrodzka

Tax Manager - Tax Adviser

E: mskrodzka@asbgroup.eu

Piotr Szeliga

Tax Manager - Tax Adviser

E: pszeliga@asbgroup.eu