Employees on business travels will receive higher amounts for covering their expenses as from 1 January 2023.

That is understandable due to the increasing costs of meals and accommodation. However, be aware of the fact that the compensations of petrol and diesel decreased in the Decree of the Ministry of Labour and Social Affairs.

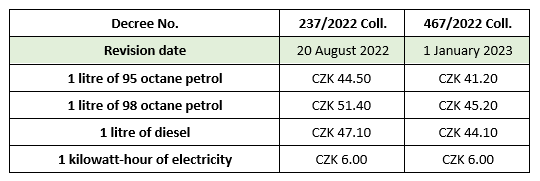

Average Fuel Prices

To calculate the reimbursement of the travel expenses, the employer may use the average price stipulated in the Decree. There is always the option to demonstrate the actual price with a fuel receipt. It is necessary to check the rates used for the fuel price calculation, because the Decree significantly reduced the prices. Only the electricity compensations remained unchanged.

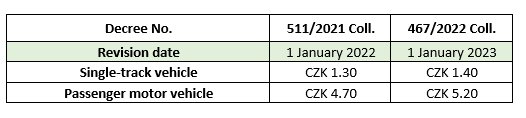

Basic Compensation Rate per km Driven

The compensation rates per km have been changed after one year. They slightly increased for single-track vehicles and for passenger motor vehicles.

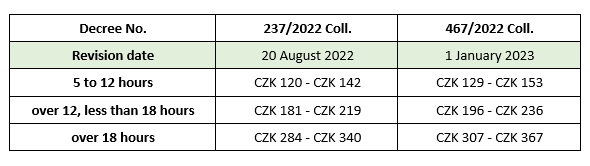

Meal Allowance on Domestic Business Travels

Changes also affected the meal allowances on business travels within the Czech Republic. In business, the employer must always respect the minimum value stipulated in the Decree, while being allowed to pay a higher amount.

Meal Allowance on Business Travels Abroad

The meal allowances on business travels abroad did not change in course of 2022. However, the amount has changed for twenty-five countries since the beginning of this year, such as for Poland (EUR 45 from 40) or Denmark and Sweden (EUR 60 from 55). On the other hand, the all-day meal allowance for business travels abroad amounting to EUR 45 still apply to Germany and Austria.

Increased Upper Limit for Subsistence Allowance

The increasing reimbursement of travel expenses also indirectly affects the employer’s ability to pay subsistence allowances to employees. The maximum amount of the meal ticket lump sum is related to the meal allowances through the tax exemption on the part of the employee. The upper limit for travels for less than 12 hours increased to CZK 153, and therefore, the maximum value of the monetary contribution per shift is amounting to CZK 107.10 (the maximum amount was CZK 99.40 from August 2022).

Download PDF: CHANGES IN REIMBURSEMENT OF 2023 TRAVEL EXPENSES