Change in the limit for VAT registration and increase in the upper limit of the flat-rate regime for personal income tax.

At the beginning of the summer, the Chamber of Deputies approved the first reading of a bill amending the limit for mandatory VAT registration and the amount of total income for the possibility of applying the flat-rate regime for personal income tax. The bill is scheduled to take effect on 1 January 2023.

The historical turnover limit for mandatory VAT registration, which has been in force since the Czech Republic joined the European Union in 2004, should be increased from CZK 1,000,000 to CZK 2,000,000 on the basis of the proposed amendment to the VAT Act. According to the proposal, current taxpayers should be able to opt out of VAT if their income falls below the upper limit of CZK 2 million.

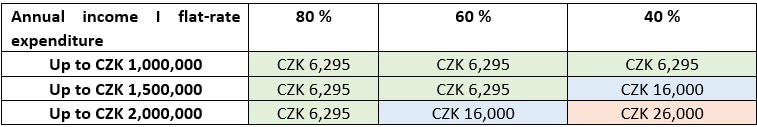

At the same time, the bill also includes an increase in the self-employment income threshold for possible entry into the flat-rate tax regime for self-employed persons from CZK 1,000,000 to CZK 2,000,000. As this is a wide range of income, 3 brackets will be introduced at the same time to determine the amount of monthly advance payments, based on the annual income threshold and the applicable expense allowance. The identified brackets and the amount of the proposed advance payments for 2023 are shown in the table below:

Last but not least, the bill extends the possibility of applying extraordinary depreciation of assets from the first and second depreciation groups acquired in 2022-2023. It will build on the extraordinary depreciation of assets that was introduced for 2020-2021 to reduce the negative impact of the Covid pandemic. Taxpayers can depreciate new assets in the first depreciation group in a reduced period of 12 months and assets in the second depreciation group in a period of 24 months.

The next hearing on the bill is scheduled for 6 September.