The new law on Insurance Premium Tax, which may concern also your Company, came into effect from 1 January 2019. We would like to provide you with the most important details about this new tax.

SUBJECT OF INSURANCE PREMIUM TAX (“IPT”)

Subject to IPT is an insurance, which meets the following criteria:

- Insurance is classified as non-life insurance listed below. Reinsurance is not subject to tax;

- Insurance risk is located in the Slovak Republic. The risk is located in Slovakia in the following cases:

As an example, IPT will also apply to cases when a foreign parent company signs a group policy with third-country insurance company and this policy covers insurance risks of its subsidiary in Slovakia, as well. Should this be the case, pro-rated insurance premium allocated/ recharged by parent company to Slovak subsidiary will be subject to Slovak IPT. Slovak subsidiary is liable to register for IPT and pay a tax.

CATEGORIES OF NON-LIFE INSURANCE

(ties with second page of IPT tax return):

- Accident insurance

- Sickness insurance

- Land vehicles damage or loss insurance (other than railway rolling stock)

- Railway rolling stock damage or loss insurance

- Aircraft damage or loss insurance

- Ships / Vessels damage and loss insurance

- Goods in transit insurance, including baggage and all other goods, irrespective of the form of transport

- Property damage and loss insurance other than referred to in points 3 through 7 due to fire, explosion, storm, natural forces other than storm, nuclear energy, land subsidence

- Other property insurance against damages and losses other than those referred to in points 3 through 7 due to hail or frost or any event (such as theft) other than those mentioned under point 8

- Carrier’s liability insurance

- Liability insurance arising out of the use of aircraft, including carrier’s liability

- Liability insurance arising out of the use of ships, vessels or boats on the sea, lakes, rivers or canals, including carrier’s liability

- General liability insurance other than referred to in points 10 through 12

- Credit insurance

- Suretyship insurance

- Miscellaneous financial losses insurance

- Legal expenses insurance

- Assistance insurance

PERSONS LIABLE TO TAX

The person liable to pay tax shall be:

- Insurance /assurance company; however, this obligation may concern also t

- Policy holder, if this legal entity pays the premium to a third-country insurer, who does not have a branch in the territory of Slovakia or to

- Legal entity to which the costs of such insurance are recharged.

TAXABLE EVENT (TAX DATE)

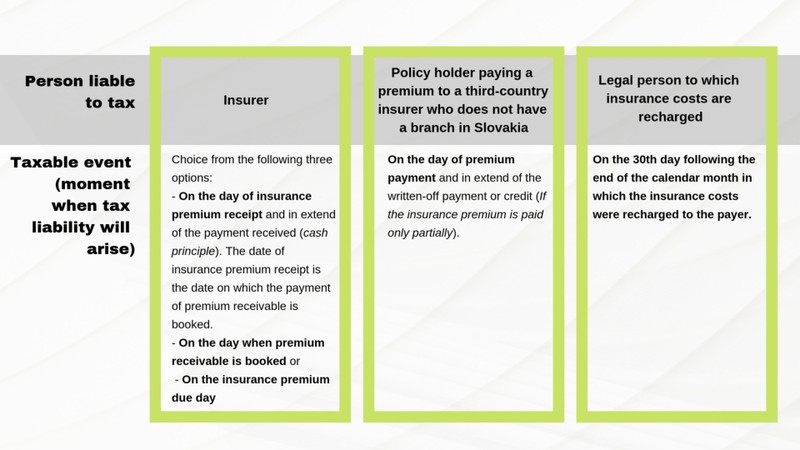

The moment when the tax liability will occur depends on the person liable to tax. In case of insurance / assurance company the law gives three options. The insurer may opt for one of them; however the selected option must be applied consistently for at least 8 consecutive calendar quarters (2 years). The selected option is marked directly in IPT return.

The following scenarios are possible:

TAX BASE AND TAX RATE

The tax base depends on the person liable to pay tax:

- Should insurance /assurance company be obliged to collect tax, tax base is the amount of received insurance premium less tax;

- Should Policy holder or person to which the insurance costs are recharged, tax base is the amount of insurance premium (allocated costs)

- Tax rate is 8% from tax base. Tax rate is 0% in case of mandatory motor vehicle liability insurance (This insurance is covered by special levy).

TAX LIABILITY AND TAX PERIOD

Tax will be levied on all insurance policies, regardless the date of the concluding of that agreement, if the insurance period starts after 31 December 2018.

Tax period is calendar quarter. A person obliged to pay the tax must electronically file IPT tax return for the relevant tax period. Deadline for e-submission is by the end of the next calendar month following the end of the taxation period in which the tax liability arose. Tax is due within the same deadline.

In 2019 the deadlines for IPT return and tax payment are as follows:

Tax Period → Deadline

1Q 2019 → 30 April 2019

2Q 2019 → 31 July 2019

3Q 2019 → 31 October 2019

4Q 2019 → 31 January 2020

TAX RECORDS

Tax payers are obliged to keep tax records for each tax period. The records must contain the following information:

- Identification of policy holder (name, address)

- Identification of insurer (business name, address)

- Number of insurance policy

- Amount of insurance premium

- Amount of tax base

- Amount of tax

- Tax rate

- Information on location of risk in Slovakia

Upon request of Tax Administration also tax records can be e-filed with authorities.

For more information or for ordering of tax service please contact our office on:

T: +421 2 5464 1187

E: assistant@asbgroup.eu