In the recent 20 years, CEE countries have been increasingly attracting the attention of investors from the real estate sector worldwide. The answer to the question “why?” becomes quite obvious when you dig into details of the level of yield in particular countries of Europe.

Investors prefer to locate their funds in our region since they may expect to double their profits here. In 2019Q2 the market price office yield reached 7.15% in Bucharest, whereby it amounted solely to 2.9% in Germany.

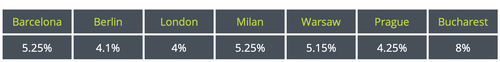

Please see below the numbers for Western Europe:

Market price office yield – 2019Q2 – Western Europe

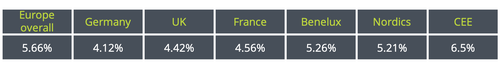

And now let’s compare it with the level of yield in our region:

Market price office yield – 2019Q2 - CEE

It occurred than in 2019Q2 in our region investments in the top office sector happened to be most fruitful in Slovakia and Hungary.

What is interesting, once you have a look at the level of prime industrial yield it occurs that in some cases cities of Western Europe offered higher return for investors when compared to investments made in Central Eastern Europe. Please see below:

Prime industrial yield – 2019Q2 – Europe

What about logistics units? Basing on data for 2019Q2 we may come to the conclusion that investing in logistics units in CEE should result in higher profit for investors than investing in countries of Western Europe. Please see the bundled yield for particular areas:

Logistics units yield – 2019Q2 – Europe

Having in mind these numbers, one should remember than without friendly tax legislation allowing investors to reinvest generated profits without its taxation “on-the-spot” it will be difficult for Poland to compete against Czech Republic, Slovakia, and Hungary. These countries offer so-called participation exemption from Corporate Income Tax for its investors. This instrument allows reinvesting profits generated in these countries from the sale of RE investments without tax leakage upon sale.

The Polish government teases the investors about the plans to introduce so-called Estonian CIT – which allows for taxation not earlier than upon distribution towards investors – as well as REIT - Real Estate Investment Trust. However, we have not seen any ground-breaking legislation activities in this context. And the plans are clearly not enough.

The longer the investors wait for these preferences, the lesser probability that funds gathered by them will be designated to Poland and not to the Czech Republic, Slovakia, or Hungary.

Time for action. The moment is perfect.

Should you have questions, please contact our experts:

Łukasz Bączyk

Head of Tax, Board Member

E: lbaczyk@asbgroup.eu

Jarosław Szajkowski

Tax Manager - Tax Adviser

E: jszajkowski@asbgroup.eu

Marta Skrodzka

Tax Manager - Tax Adviser

E: mskrodzka@asbgroup.eu

Piotr Szeliga

Tax Manager - Tax Adviser

E: pszeliga@asbgroup.eu

Paweł Jóźwik

Tax Manager - Attorney-at-law

E: pjozwik@asbgroup.eu