On 11 May, the government introduced the long-awaited and discussed tax package, which should help the Czech Republic cope with the growing deficit of the state budget.

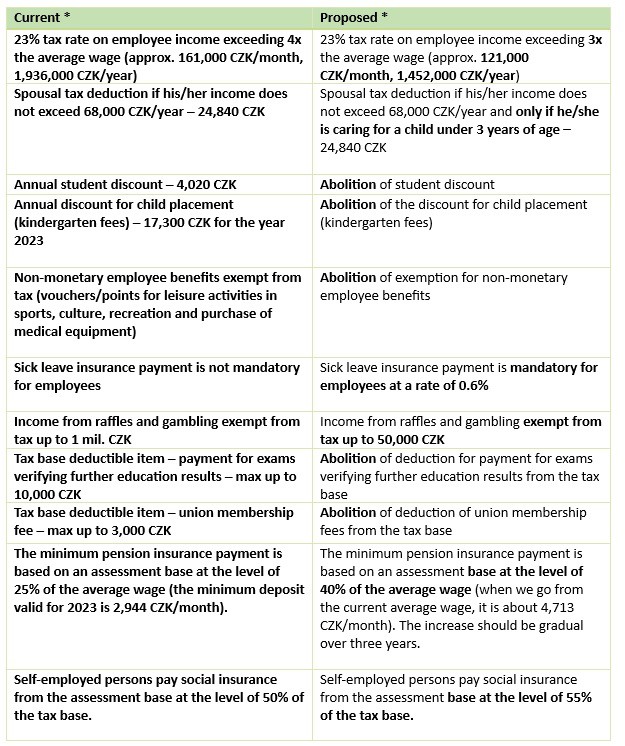

The so-called Recovery Package contains a total of 58 measures. We have selected for you a comparison of those that will affect almost all of us, namely personal income tax and social security payments.

* The table lists individual changes concerning individuals, compared to the situation before the proposed changes.

New Conditions for Payments from Work Agreements

A relatively unobtrusive change, but significant for many employers, are the work agreements. For popular “Agreements”, two limits for the creation of insurance contributions for employees working on the basis of a work agreement are introduced in the proposal.

- The first limit applies to a work agreement with one employer – earnings up to 25% of the average wage, i.e., up to 10,088 CZK;

- The second limit applies to work agreements with multiple employers at the same time - earnings up to 40% of the average wage, i.e., up to 16,141 CZK.

We have calculated the amounts based on the average wage in 2022 (at 40,353 CZK). If one of the above limits is exceeded by an employee working under a work agreement, the insurance will also be deducted from the paid amount.

Employers will have a new recording obligation in connection with work agreements. They will have to report all agreements to the Czech Social Security Administration. How the insurance of agreements will look in practice and how the established limits will be monitored among employers is a question now.

The biggest public discussion so far is sparked by the intention to “abolish employee benefits”. What does the abolition of exemption mean? We’ll explain it with a simple example. Let’s say an employee receives 1,000 CZK per month into the benefit program. With this money, they can pay for entry to a sports facility or a cinema ticket, or they can make a purchase at the pharmacy. These 1,000 CZK are exempt from income tax and related insurance, which means that the employee receives the money “net”. If the employer added the same amount to the employee's salary, the employee would receive only 740 CZK on their account after all deductions and discounts.

All proposed changes are so far the first presentation of intentions. The government has not yet incorporated these changes into the current amendment. We will be monitoring the situation for you and will keep you informed about the developments.

Download PDF: 2023 Recovery Tax Package | Table